Public Unit Deposit Collateralization: Multiple Benefits to The FHLB Des Moines Member and to the Public Unit Depositor

last updated on Monday, March 12, 2018 in Letters of Credit

Public Unit Deposits as a Source of Financial Institution Funding

Many member financial institutions of FHLB Des Moines gain funding access via NOW, MMDA or time deposits from municipalities or political subdivisions. Examples include: school districts, bridge and port authorities; or sanitation, utility and fire districts. Deposit requirements often vary in magnitude in concert with seasonal revenue collections and/or collection of bond proceeds. Public unit depositors are principally concerned with the creditworthiness, safety and soundness of the depository. As a result, public units are frequently bound by statutes and/or investment policies to require collateralization of deposits in excess of Federal Deposit Insurance Corporation (FDIC)/National Credit Union Administration (NCUA) limits of $250,000. Per the FDIC, “Collateralization provides an avenue of recovery in the unlikely event of the failure of an insured bank.”

Seeking Optimal Forms of Public Unit Deposit Collateralization

Collateralization options vary (depending upon statutes and investment policy), and may include: FHLB Des Moines or Federal Reserve Letters of Credit, surety bonds or pledging of a depository's eligible securities. Although pledged securities as a form of collateralization has historically been the most widely used method, especially during times of excess liquidity, this form of collateralization encumbers highly liquid assets. Pledged securities are typically held by a trustee or custodian and require generation of frequent collateral reports that detail market values, substitutions and other information to the public unit depositor. Also, pledged securities often need to be closely monitored for replacement caused by calls and maturities. As alternatives, surety bonds that are commissioned by financial institutions for public deposit collateralization can be expensive and subject to calls by the underwriter, monthly reporting on daily deposit levels and may be subject to changing capacity limitations. Finally, reciprocal deposits are sometimes viewed as a means of directing public unit deposits; although capacity and settlement limitations may not coincide with public unit deposit cash flow, may be operationally intensive, and may subject the municipal depositor to overnight settlement risk. As a solution, public units and depositories are increasingly seeing the benefits of covering deposits via procurement of a FHLB Des Moines Standby, irrevocable Letter of Credit. Such a letter of credit may be written in favor of a public unit depositor in the event a depository fails. Under such an event, the public unit would have the ability to immediately draw upon the letter of credit. The amount of any such letter of credit is incorporated within a member financial institution's collateral and credit lines at FHLB Des Moines.

More on the Public Unit Deposit Letter of Credit Alternative

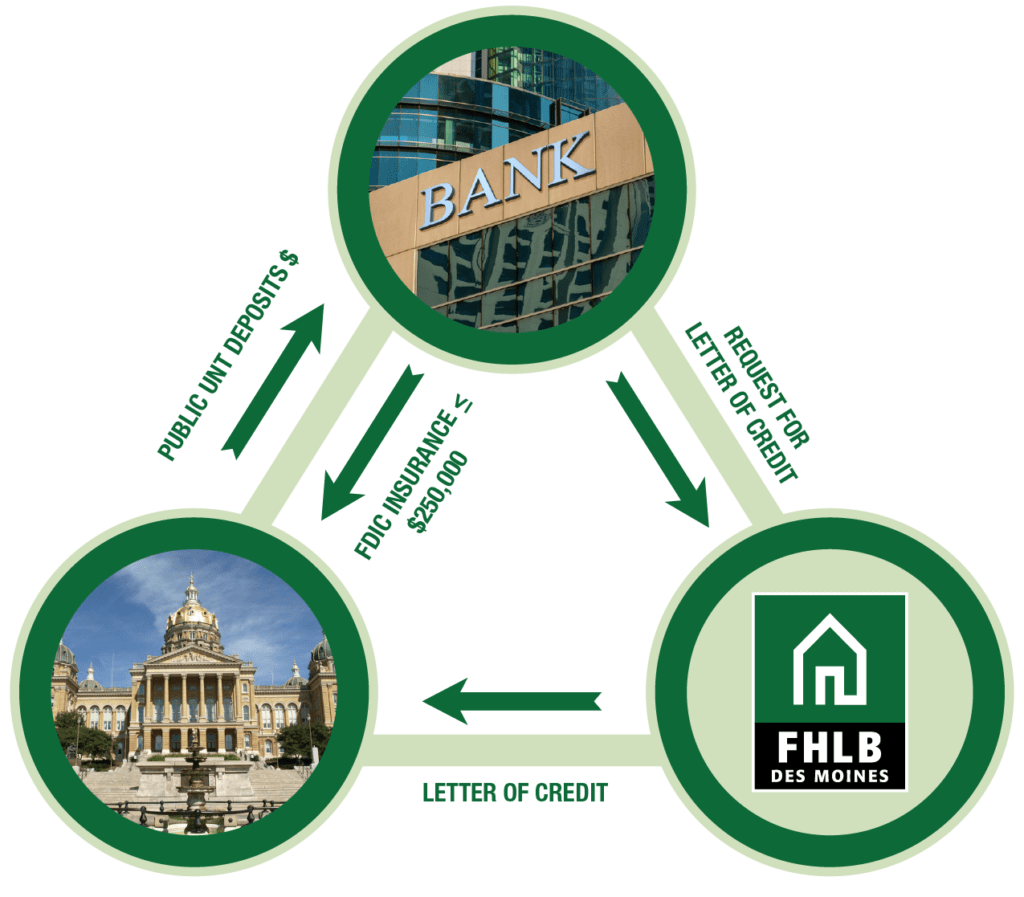

As illustrated in Figure 1, there are several contractual and transactional flows associated with public unit deposits that are backed by FHLB Des Moines Standby Letters of Credit. An FHLB Des Moines member institution requests a letter of credit via an application. Next, a letter of credit is generated in favor of a public unit. Once the letter of credit is in place, the member financial institution is set to generate funding from the public unit, now that the institution's deposits in excess of the FDIC insurance limit of $250,000 are adequately covered.

Figure 1

The costs associated with issuing an FHLB Des Moines Letter of Credit are minimal from the perspective of a member. There is no cost borne by the public unit depositor. Relative to pledging securities, letter of credit issuance is more operationally efficient and does not encumber a securities portfolio. Moreover, a case can be built that by reducing the amount of pledged securities, a member may be encouraged to redirect capital from low-yielding investments to higher yielding assets such as loans. Currently, public unit deposit-related letter of credit activity is conducted by FHLB Des Moines within the vast majority of jurisdictions. There are several states outside the district that will also accept FHLB Des Moines Letters of Credit. Many states have specific public deposit statutes that reference the ability of their public units to accept FHLB Des Moines Letters of Credit. Many municipalities recognize the benefits of the “Aa1”/”AA+” rating and see letters of credit as easier to monitor than securities. Public unit depositors, which, again, are extremely safety conscious, recognize that in the event of default, exercising the right to security collateral may be more time consuming than simply drawing on a letter of credit.

Public Unit Deposit Collateralization: Multiple Benefits to the FHLB Des Moines Member and to the Public Unit Depositor

Standby Letters of Credit issued on behalf of FHLB Des Moines members and in favor of their public unit depositors can: i) help diversify collateralization methods, ii) relieve the administrative complexities of substituting securities, iii) improve member liquidity metrics and iv) encourage members to redirect capital to core, higher-yielding assets. FHLB Des Moines is a widely accepted collateralization counterparty by public units. Feel free to contact your Relationship Manager about the specific impact that FHLB Des Moines public unit deposit Letters of Credit can have on your institution.

TAGS

- Funding

- Letters of Credit

- Standby Letter of Credit

- Strategies