Expanding Markets, Expanding Letter of Credit Uses

last updated on Tuesday, March 12, 2019 in Letters of Credit

At the start of the year amid record cold temperatures across the U.S., thoughts readily turn to summer recreation. Jack Nicklaus once stated, “There are always new places to go fishing. There’s always a new place - always a new horizon.” The same notion would apply to financial institutions identifying ways to expand their uses of letters of credit with the Federal Home Loan Bank of Des Moines.

A letter of credit from the Federal Home Loan Bank of Des Moines is a well-established means of giving members the ability to guarantee contracts and obligations on behalf of themselves as well as their customers. By leveraging the strong credit rating of the Bank, there are many ways to apply letters of credit to a number of purposes. While the most popular application of an FHLB Des Moines Letter of Credit (LOC) is collateralizing Public Unit Deposits for the purpose of covering municipal deposit levels in excess of levels covered by FDIC insurance in lieu of pledging securities; there are many other common uses that are often overlooked. Many of these uses are connected to the promotion of member liquidity and asset/liability positions, along with lending for community development and affordable housing. Broadly, uses can include:

-

Enhancing the credit rating and liquidity of taxable housing and non-housing bonds, as well as tax-exempt housing bonds. Often, a real estate or project financing that is structured with an FHLB Des Moines Letter of Credit can feature a lower net rate to the borrower and a higher return on capital for the member institution relative to structuring a financing via a direct loan.

-

Providing select liquidity, community lending, housing and other enhancements for the benefit of members, their customers and communities. Examples include: rating confirmation requirements on behalf of interest rate swap and other counterparties, completion of construction projects, lease payment guarantees, backing of self-insurance and workers’ compensation programs.

Understanding the Confirming Letter of Credit Structure

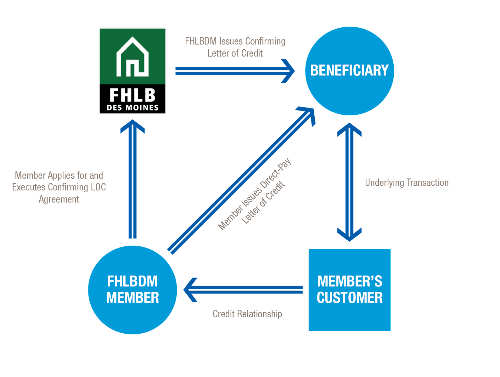

Whereas standby letters of credit directly support the obligations of FHLB Des Moines members, confirming letters of credit confirm a member’s obligations that it has made under its own, separate letter of credit. Figure 1 demonstrates the flow of a typical transaction:

-

An underlying transaction is created. As shown in Figure 1, beneficiaries such as a bond trustee that is acting as a conduit for a housing project financing, or an insurance authority that requires levels of security for the purpose of establishing a self-insurance program could require transactional support in the form of posted security or a letter of credit from an acceptable counterparty.

-

A member issues a direct pay letter of credit in favor of a beneficiary. The letter of credit covers the credit ability of the member’s customer to fulfill the obligation.

-

Not solely accepting the direct counterparty status of the member, the beneficiary requires a confirming letter of credit with a strong credit counterparty, in this case FHLB Des Moines and its long-term credit rating of “Aa1/AA+”.

In the event of a default on the underlying credit by the member’s customer or funded project, the member’s direct pay letter of credit could be drawn, thereby converting the contingent liability into an on-balance sheet asset of the member. In these circumstances, a pre-set default rate would typically be set whereupon the member bank would convert the obligation into a conventional loan. The credit relationship would reside between the member bank and its customer. At the outset, FHLB Des Moines would earmark the amount of the confirming letter of credit against the member’s established credit and collateral availability.

Figure 1. A Typical Confirming Letter of Credit Structure

Expanded LOC Application: Enhancing the Credit Rating and Liquidity of Tax-Exempt Housing Debt and Tax-Exempt/Taxable Non-Housing Debt

Confirming letters of credit are frequently used to support bond issuances and private placements for project and construction financings in both the housing and non-housing (community investment) sectors. Examples include multi-family mixed use housing project bonds that are issued on a tax-exempt basis, or privately-placed debt on behalf of the construction of office buildings in commercial revitalization zones. Indeed, confirming letters of credit can encompass: housing developments, healthcare facilities, job-producing commercial projects, schools and more.

From the perspective of the FHLB Des Moines member, there can be some compelling reasons to consider issuing a direct-pay letter of credit with an accompanying FHLB Des Moines Confirming Letter of Credit. First, the structure gives the member the ability to generate fee income. Second, the FHLB Des Moines member could have the ability to generate a return on equity that is superior to structuring a transaction as a direct loan. Why? As opposed to funding a direct loan, holding a contingent liability typically results in a reduced amount of required risk-adjusted equity.

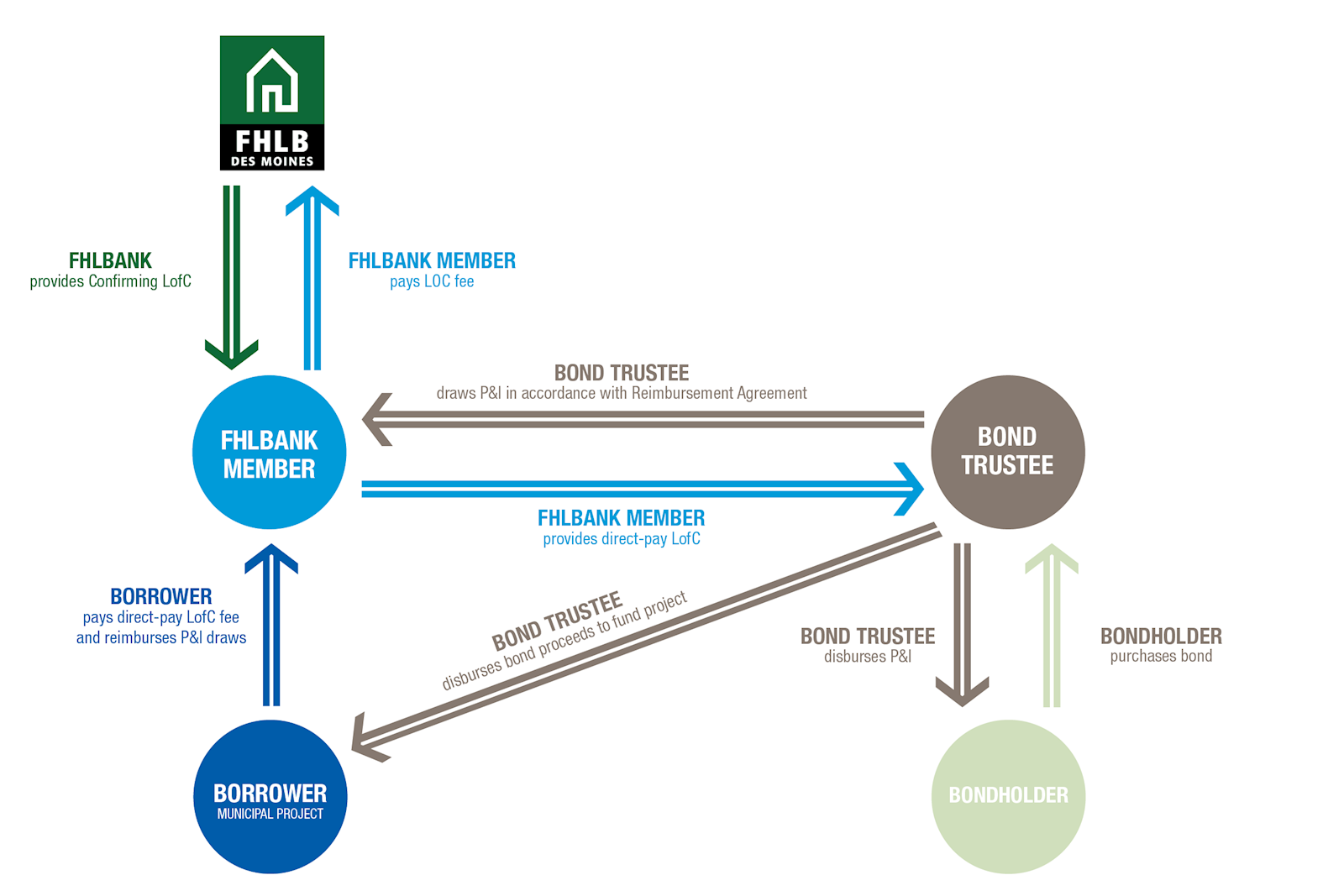

Figure 2 displays a representative transactional structure involving usage of a confirming letter of credit in a bond financing.

Figure 2. Representative Transaction Flow of a Financing a Project via a FHLBDM-Provided Confirming Letter of Credit

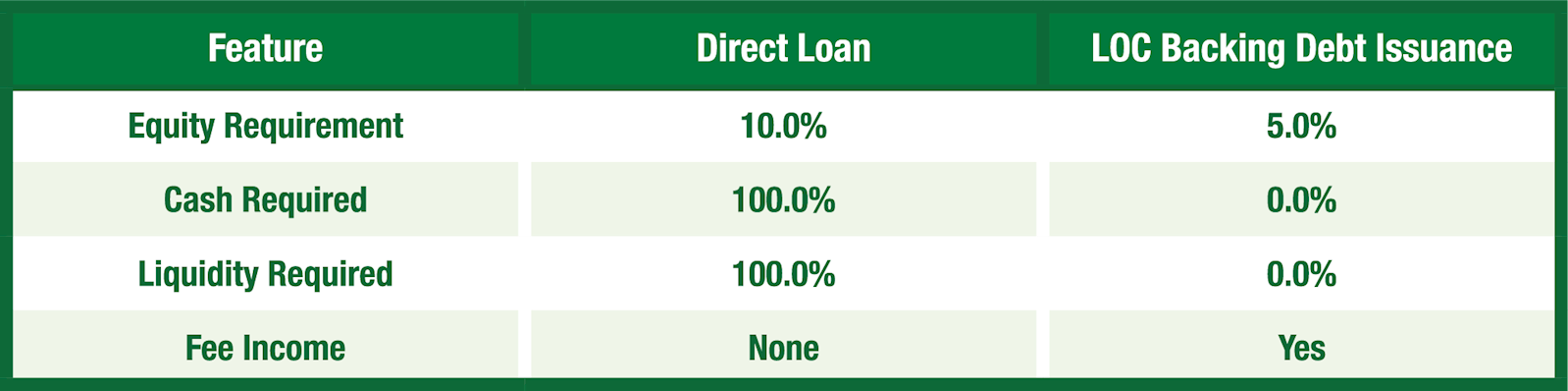

To the extent that the asset size of a member falls within allowable regulatory limits, the letter of credit (given that it would be treated as a contingent liability) could result in favorable capital risk weighting treatment instead of making a direct loan on a project. As such, a member might, under certain circumstances, be able to structure a viable funding alternative to a direct loan that yields a superior return on equity. Again, as Figure 3 illustrates, the equity required on a direct pay letter of credit could require less risk adjusted capital than would a direct loan. Per FDIC Call Report RC-R (Credit Conversion Factors for Off-Balance Sheet Items), off-balance sheet items that include “transaction-related contingent items, including performance standby letters of credit, bid bonds, performance bonds and warranties” are subject to a 50% capital conversion ratio.

Figure 3. Example of Direct Loan Features vs. Direct Pay Letter of Credit Confirmed by FHLB Des Moines Letter of Credit Backing a Debt Issuance

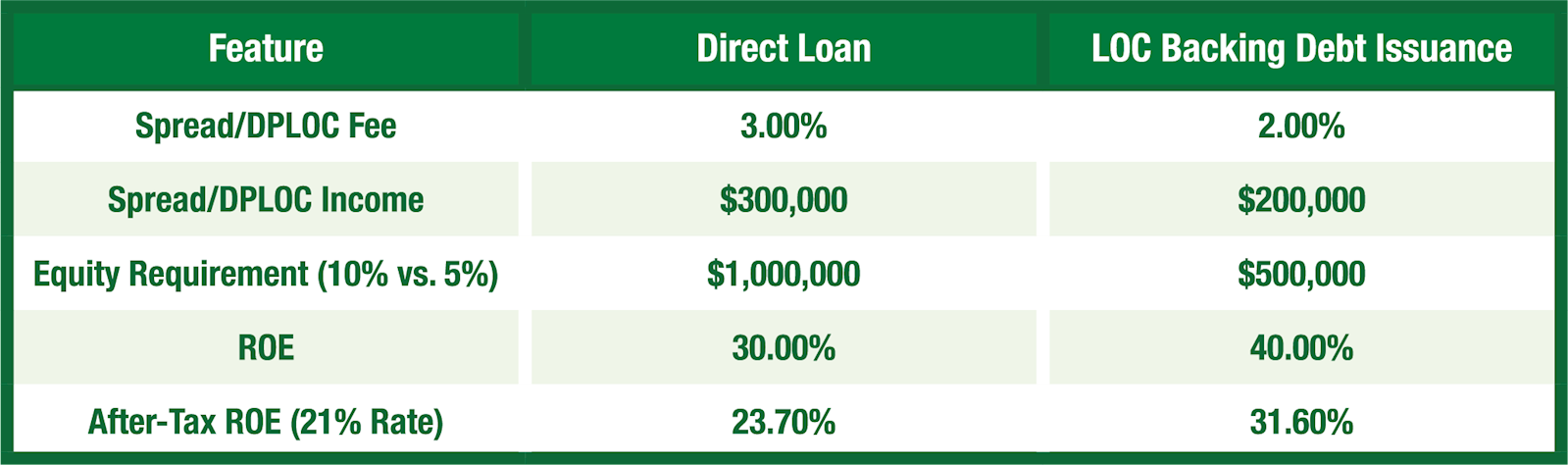

As illustrated in Figure 4’s example assumptions, the equity requirements of each alternative could next be measured against spread income scenarios for direct loan vs. the net letter of credit fee rates. In many cases, the return on equity favors the structure in which a letter of credit backs a debt issuance. It’s always a good idea to speak with bond dealers and financial advisors that specialize in structured project financings in order to remain current on market rates for letters of credit, rating, trust, closing and other costs. Issuance costs for Confirming Letters of Credit provided by Federal Home Loan Bank of Des Moines represent a small fraction of the overall fee income that the member would derive from issuing its own, primary and direct letter of credit.

Figure 4. Example of Risk-Adjusted ROE to a FHLB Des Moines Member on a Hypothetical $10 million Direct Pay Letter of Credit vs. Making a Direct Loan

Aside from standard fixed rate debt financing, other structures including variable rate demand notes are often conducive to a letter of credit-backed structure. Many of these structures are purchased by money market funds that require ”AAA” ratings. Rates typically re-set on a weekly basis. These notes are often structured with direct pay letters of credit that are issued by member banks in favor of debtholders, along with a FHLB Des Moines Confirming Letter of Credit that backs the member’s primary LOC.

Bolstered by a top debt rating, confirming letters of credit issued by FHLB Des Moines in support of bonds or private debt placements can further enhance the financial strength of an underlying project. Not only will the letter of credit feature facilitate a favorable interest rate on behalf of the issuer, it can also provide a member financial institution the opportunity to derive ROE-enhanced fee income.

Expanded LOC Applications: Providing Select Liquidity, Community Lending, Housing and Other Enhancements for the Benefit of Members and Their Customers and Communities

Many financial institutions use letters of credit from FHLB Des Moines for either satisfying financial obligations either on their own behalf, but also on behalf of their customers and communities. Examples include:

-

Supporting Performance Obligations (e.g. contracts, bids, leases, project completion)

-

Backing Self-Funded Workers Compensation Programs

-

Establishing Self-Insurance Programs for Unemployment, Liability or Other Forms

In cases involving self-insurance, carriers and/or governmental authorities often require payment guarantees, generally in the form of either pledged securities or letters of credit issued by an acceptable counterparty. Pledged securities can unnecessarily deploy capital and could be subject to collateral calls in the event of reduced market valuation.

Workers’ compensation self-insurance opportunities may arise in situations involving compliance with state and local laws that require compensation for on-the-job injuries. As a result, companies typically engage insurance companies as a risk management measure. Alternatively, more financial institutions, as well as their customers, are now taking responsibility for their own claims by self-insuring. Self-insurance programs often entail the use of third-party claims administrators for administration and loss management. Also, self-insurance programs typically involve the self-insured purchasing coverage for claims that are far in excess of expectations. Letters of credit can play an important role in self-insured workers’ compensation plans. Why? States and other authorities frequently require self-insured programs to guarantee claims in the event the sponsor cannot fulfill the obligation. FHLB Des Moines Letters of Credit can either be applied on a direct pay (standby) basis in the case of an insurance company member that is providing workers’ compensation services, or on a confirming basis in support of a member’s customer. Under the latter instance, the member would supply a direct pay letter of credit to the State or appropriate authority, while FHLB Des Moines would issue a Confirming Letter of Credit in the event the member could not fulfill a draw against its letter of credit.

FHLB Des Moines members have also called upon Letters of Credit to support their customers’ other self-insurance needs. As an example, expanding transportation fleet operators have self-insured their property and casualty programs using Direct Letters of Credit supplied by members that are confirmed by FHLB Des Moines. The same structure would apply in the case of guaranteeing contract performance in the case of leases, infrastructure projects and other applications.

Conclusion

While most FHLB Des Moines members are aware of the benefits of using Letters of Credit for the purpose of providing municipal depositors’ coverage beyond FDIC insurance thresholds, expanded uses can benefit members, their customers and communities. In many cases, an FHLB Des Moines Letter of Credit can enhance an obligation that otherwise could not have been achieved. Whether it’s an opportunity to drive fee income and enhance ROE by backing a bond, supporting a self-insurance program, or covering a customer’s performance obligation; it may be worth your while to explore some of these expanded uses of letters of credit and discuss them with your Relationship Manager. You’ll find that FHLB Des Moines Letters of Credit can be used to strengthen communities, create jobs and expand your markets.

TAGS

- Confirming Letter of Credit

- Letters of Credit

- Solutions

- Standby Letter of Credit

- Strategies