Maximize Your Down Payment Funds Through Community Partnerships

last updated on Friday, March 26, 2021 in Affordable Housing

Many FHLB Des Moines members utilize the Bank’s Down Payment Products, Home$tart and the Native American Homeownership Initiative (NAHI), to provide much needed down payment and closing cost assistance to low-to-moderate income customers.

What if your institution does not have a pipeline of eligible first-time homebuyers? Can Home$tart and NAHI still be used to meet the needs of your institution and community?

The answer is yes!

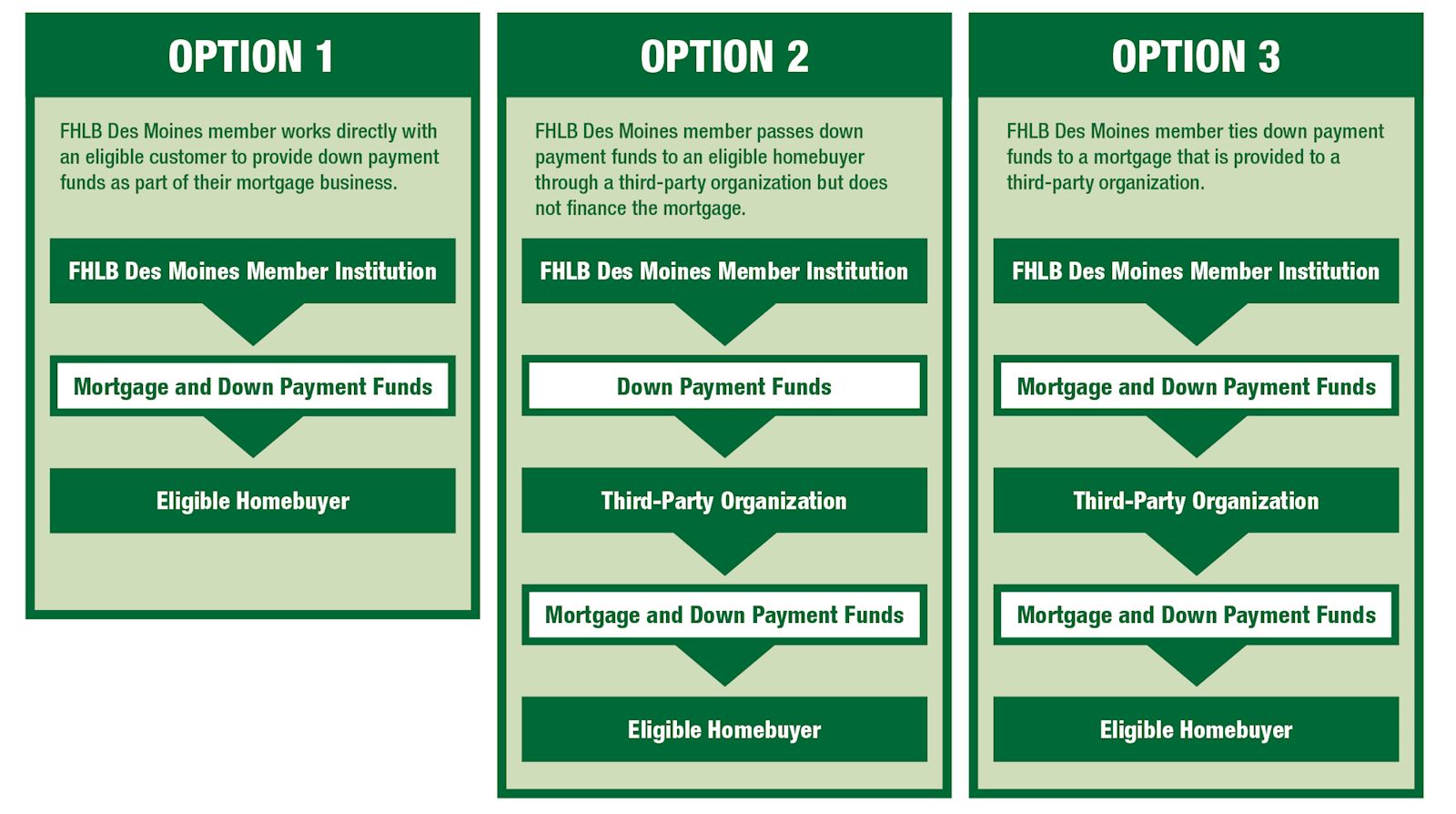

Through these programs, FHLB Des Moines members have the option to partner with third-party organizations to reach low-to-moderate homebuyers outside of their customer base. These down payment funds can be passed directly through a third-party organization to eligible first-time homebuyers or can be tied to a mortgage that your institution will provide to the third-party organization.

Benefits of Partnering with a Third-Party Organization

- Supports your community’s needs for affordable housing

- Provides deeper reach to low-to-moderate-income first-time homebuyers

- Provides an opportunity to gain CRA credit for your institution

- Creates higher visibility of your institution in the community

Uses of FHLB Des Moines Down Payment Funds

How Does the Process Work?

The process for requesting down payment products is the same, regardless of whether you are working with your own customer or going through a third-party organization.

FHLB Des Moines members are responsible for submitting the funding request and collecting all of the necessary documentation from the homebuyer. Members can collect this information through their third-party partners or work directly with the homebuyer.

Members will continue to front the funds for the homebuyer and be reimbursed by FHLB Des Moines at the time of disbursement once all required documentation has been reviewed and approved.

When partnering with a third-party organization, FHLB Des Moines also recommends establishing clearly defined roles.

FHLB Des Moines members are encouraged to work with the third-party organization prior to submitting a funding request to determine how the down payment funds will be used. Such factors for consideration may include the total number of homebuyers be supported and the funding amount available to each homebuyer.

Reminder: Individual funding requests are limited to up to $7,500 through Home$tart or $15,000 through NAHI. Members are also subject to a $90,000 overall cap in 2021 for Home$tart funds and a $90,000 overall cap in 2021 for NAHI funds.

Questions?

Contact the FHLB Des Moines Down Payment Product team with questions or to schedule a joint training session for a third-party organization.

Contact Us