Member Map of Credit and Collateral

As a member-owned cooperative, it’s the responsibility of the Federal Home Loan Bank of Des Moines to be a reliable source of liquidity for our member institutions. In order to deliver on that promise, we hold ourselves to the highest standards and operate the Bank responsibly to the best of our abilities.

This guide is intended to provide you with clarity around FHLB Des Moines credit and collateral practices. Here you will find:

This guide is intended to provide you with clarity around FHLB Des Moines credit and collateral practices. Here you will find:

- How credit is extended to members

- Details pertaining to pledged collateral value

- Suggested practices to minimize the impact of a reduction in credit capacity and to maximize your collateral capacity position

We hope that by providing transparency into credit and collateral practices at the Bank, we can work together to strengthen the creditworthiness of the cooperative while also optimizing your capacity to use advances, Letters of Credit and the MPF® Traditional mortgage product.

Navigate to key topics:

1. How Credit is Extended to Members:

Each member has an assigned credit capacity and terms that are regularly evaluated and determined by our Credit department. The credit capacity for most members is at or above 30 percent of assets.

Details on the Bank’s Credit Standards are defined in the Member Products Policy beginning on page 5.

In the rare situation where a member becomes distressed, our Board of Directors has affirmed that we will continue to make advances available as long as the institution pledges sufficient eligible collateral.*

Find your institution's currently assigned credit capacity: Navigate to the Member Account Profile within eAdvantage.

Changes to your Credit Terms

The Member Credit section of our website outlines information used in determining a member’s credit terms and how they could change:

- Frequency of member’s credit capacity review

- Types of information considered during a member’s credit review

- Notification process for changes to member’s credit capacity and terms

- Collateral pledge requirements associated with various credit capacity levels

- Process for requesting exceptions

VISIT MEMBER CREDIT PAGE

2. Pledged Collateral Value:

The Bank grants or renews credit availability solely on a secured basis. Therefore, members must have sufficient eligible collateral pledged in order to use the Bank’s products.

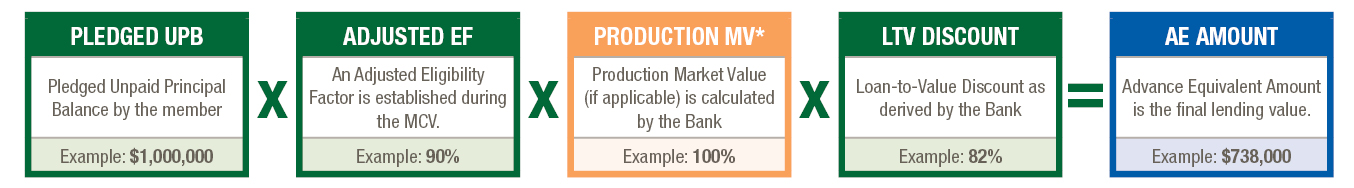

Advance Equivalent (AE) value, is the lendable value of eligible collateral after all applicable discounts. In the determination of AE, members have the most control over the unpaid principal balance (UPB) pledged and its eligibility.

Calculation of AE:

*Production MV applies to securities collateral or members with a Specific APSA or Delivery APSA,

*Production MV applies to securities collateral or members with a Specific APSA or Delivery APSA,

Pledged Unpaid Principal Balance

The Bank offers an extensive menu of loan and securities collateral eligible to secure Bank products. Make sure to submit your pledge on time to ensure uninterrupted access to Bank products.

Collateral Types Available for Pledging

Adjusted Eligibility Factor (EF) – Result of Member Collateral Verification (MCV) Review

FHLB Des Moines conducts a periodic review of a member's pledged loan collateral. The Adjusted EF represents the proportion of pledged collateral determined to be eligible at the member’s most recent MCV. Eligibility Factors can be adjusted for underwriting considerations such as the level of loan documentation. Once determined, the adjusted EF will remain in effect on a member’s pledged collateral until their next MCV.

During an MCV review, the collateral review analysts work with members to help better understand the eligibility requirements necessary to maximize the value of their pledged loan collateral portfolio.

Quickly access additional information on our MCV Process page, including:

- Frequency of MCV reviews

- MCV workflow/process

MCV Process

Loan-to-Value (LTV) Discounts

LTV Discounts are applied to the eligible unpaid principal balance of loans pledged via Borrowing Base Certificate (BBC) or general loan listing, the market value of loans pledged via expanded listing and the market value of all securities. LTV discount levels are reviewed at least annually by FHLB Des Moines and are subject to change.

LTV Information

How Collateral Capacity Changes:

|

Increase AE |

Decrease AE |

| Pledged UPB |

Balance sheet growth: pledge additional loans or securities to the Bank.

Pledge newly approved collateral types or additional collateral types. |

Release pledged loans or securities.

Failure to submit your loan pledge by the required deadline (BBC, Listing or Delivery). |

| MCV Results (Eligibility Factor) |

Improved EF by ensuring pledged loans meet underwriting criteria and are pledged in the correct type code. |

Reduced EF as a result of ineligible loan collateral found, failure to meet underwriting criteria or by pledging loans in the incorrect type code. |

3. Suggested Practices for Managing Credit and Collateral Capacity

We have additional tools and resources to help you anticipate and minimize the impact of a potential reduction in credit capacity as well as strategies for maximizing your collateral capacity position.

Anticipating and Minimizing the Impact of a Reduction in Credit Capacity

Similar to other strategies you have in place to manage liquidity risk, the Bank offers resources and information as they relate to your access to FHLB Des Moines advances and products.

READ MORE

|

Maximize Collateral Capacity

Analyzing your portfolio of pledged collateral and preparing for an MCV review will help you maximize its borrowing capacity to use FHLB Des Moines products.

READ MORE

|

Contingency Collateral Options

Additional collateral options to consider that will allow your institution to quickly pledge in order to avoid a collateral shortfall.

READ MORE

|

*This assumes the member's primary regulator does not object to the extension of credit.