Determining Collateral Capacity

The Bank grants or renews credit availability solely on a secured basis. Therefore, members must have sufficient eligible collateral pledged in order to use the Bank’s products.

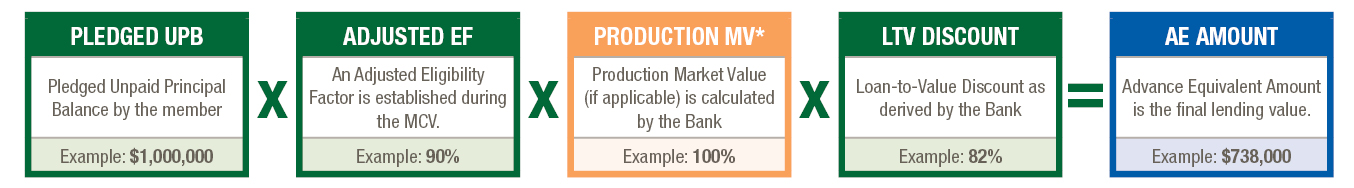

Calculation of AE:

Advance Equivalent (AE) value, is the lendable value of eligible collateral after all applicable discounts. In the determination of AE, members have the most control over the unpaid principal balance (UPB) pledged and its eligibility.

*Production MV applies to securities collateral or members with a Specific APSA or Delivery APSA,

*Production MV applies to securities collateral or members with a Specific APSA or Delivery APSA,

Pledged Unpaid Principal Balance

The Bank offers an extensive menu of loan and securities collateral eligible to secure Bank products. Make sure to submit your pledge on time to ensure uninterrupted access to Bank products.

Collateral Types Available for Pledging

Adjusted Eligibility Factor (EF) – Result of Member Collateral Verification (MCV) Review

FHLB Des Moines conducts a periodic review of a member's pledged loan collateral. The Adjusted EF represents the proportion of pledged collateral determined to be eligible at the member’s most recent MCV. Eligibility Factors can be adjusted for underwriting considerations such as the level of loan documentation. Once determined, the adjusted EF will remain in effect on a member’s pledged collateral until their next MCV.

During an MCV review, the collateral review analysts work with members to help better understand the eligibility requirements necessary to maximize the value of their pledged loan collateral portfolio.

Quickly access additional information on our MCV Process page, including:

- Frequency of MCV reviews

- MCV workflow/process

Member Collateral Verification Process

Loan-to-Value (LTV) Discounts

LTV Discounts are applied to the eligible unpaid principal balance of loans pledged via Borrowing Base Certificate (BBC) or general loan listing, the market value of loans pledged via expanded listing and the market value of all securities. LTV discount levels are reviewed at least annually by FHLB Des Moines and are subject to change.

Loan-to-Value INFORMATION

How Collateral Capacity Changes:

|

Increase AE |

Decrease AE |

| Pledged UPB |

Balance sheet growth: pledge additional loans or securities to the Bank.

Pledge newly approved collateral types or additional collateral types. |

Release pledged loans or securities.

Failure to submit your loan pledge by the required deadline (BBC, Listing or Delivery). |

| MCV Results (Eligibility Factor) |

Improved EF by ensuring pledged loans meet underwriting criteria and are pledged in the correct type code. |

Reduced EF as a result of ineligible loan collateral found, failure to meet underwriting criteria or by pledging loans in the incorrect type code. |