The Value of the Dividend

last updated on Monday, March 15, 2021 in Advances

This is part two of a two-part series examining how to fully maximize the value of your FHLB Des Moines membership. Read part one, The Value of Membership, now.

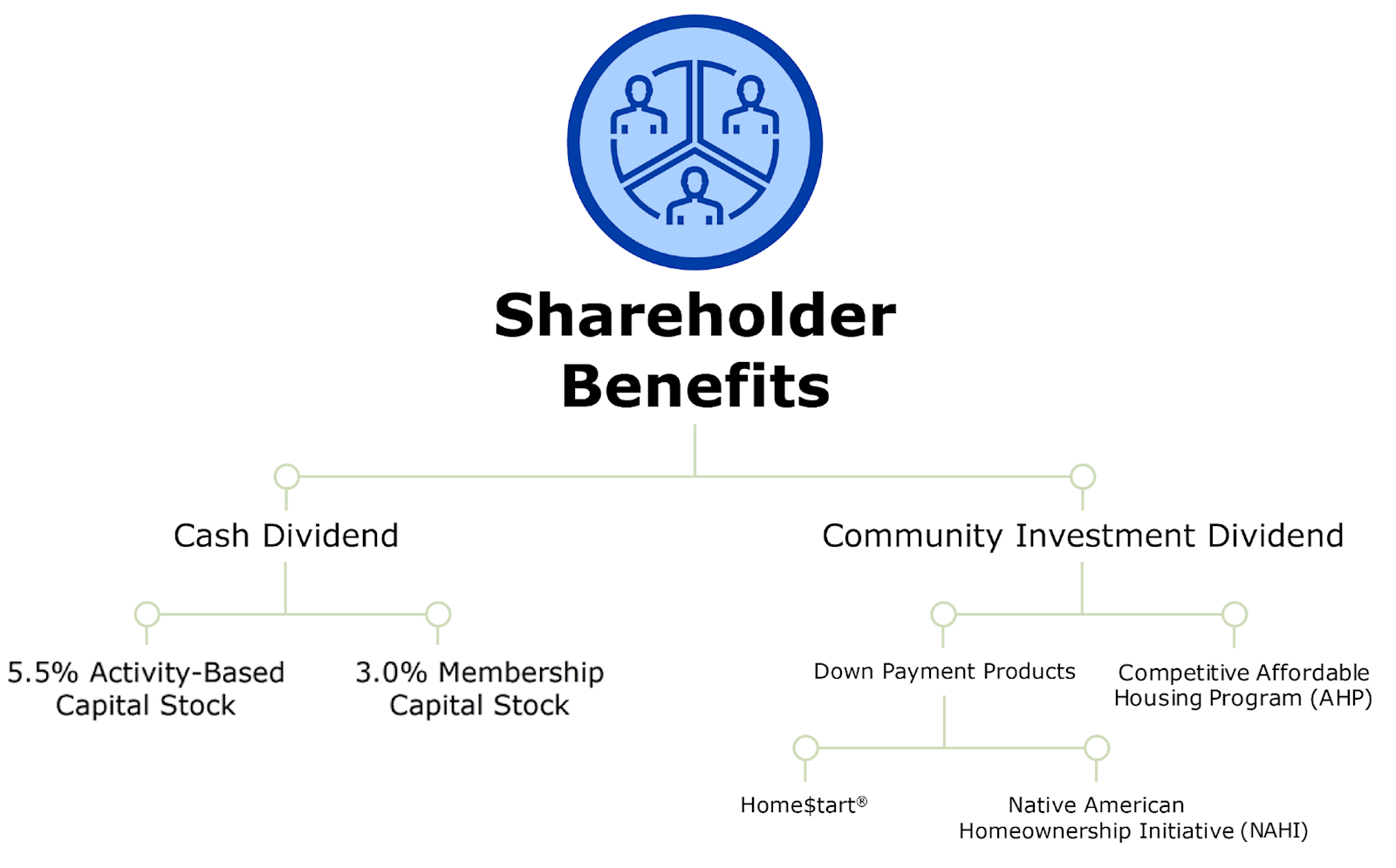

In part one of our series, we examined one half of the whole that is member benefits. As a customer, you have access to our full suite of products and services, education and much more. As a shareholder, you are entitled to a share of the Bank’s profits which take the form of a cash dividend as well as a Community Investment Dividend. Maximizing your use of the cooperative as a customer strengthens your position as a shareholder in that you not only benefit from a higher dividend but also from access to more funding to provide community support.

Access to these dividends is a unique value as an FHLB Des Moines member and not offered as a benefit by other wholesale funding sources.

Cash Dividend

The cash dividend you receive on your stock varies with the level of business your institution does with the Bank. Our fourth quarter 2020 dividend of 5.50% on activity-based stock marked the 11th straight quarter of at least 5.50%. The economic benefit of this dividend is often overlooked when evaluating the “all-in-cost” of an FHLB Des Moines advance.

All members should consider the true, all-in cost of FHLB Des Moines advances with the dividend benefit included. For example, take your 4% activity stock requirement x 5.50% dividend = 0.22% cost reduction. You can quantify the economic benefit of the dividend by using our Dividend Calculator Tool.

Community Investment Dividend

In addition to the cash dividend, our members receive an additional benefit that is arguably as impactful as the cash dividend; what we call, the Community Investment Dividend. As a shareholder, you have access to grants that can be used to support projects and other homeownership initiatives in your community. This not only strengthens the communities you serve but generates community goodwill for your financial institution.

Ten percent of our net income is allocated annually to our Affordable Housing Program (AHP). The more you utilize your cooperative, the more money goes towards our net income at the end of the year, resulting in a higher allocation of AHP funds. The Community Investment Dividend is a win-win for you and your community!

Are you fully utilizing your shareholder benefits?

Reach out to your relationship manager to learn more about how to calculate your true all-in cost with our dividend or learn more about maximizing your Community Investment Dividend through our AHP.

TAGS

- Membership Benefits