The Value of Membership

last updated on Wednesday, February 17, 2021 in General

This is part one of a two-part series examining how to fully maximize the value of your FHLB Des Moines membership.

As a cooperative, owned and operated for the benefit of our member institutions, our success is driven by the success of our members.

Success can mean different things to each of our more than 1,350 members, but at its core, success comes from fully utilizing all of the value your membership affords you.

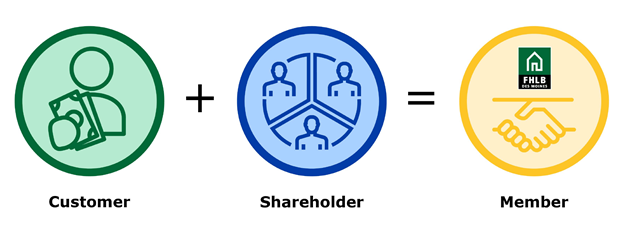

At FHLB Des Moines, we believe in order to maximize the value of their membership, members must fully utilize both their customer and shareholder roles.

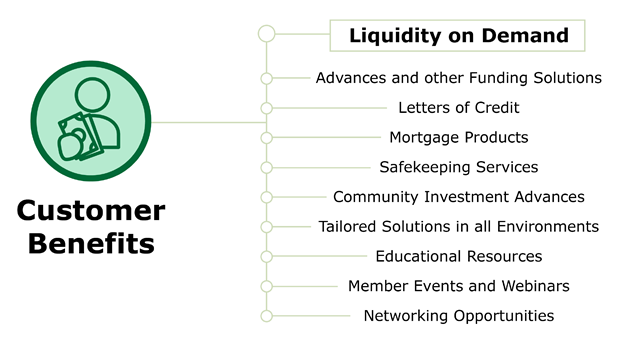

As a customer of the cooperative, you have access to and influence on the products and services Federal Home Loan Bank of Des Moines provides. It is critical to us as your partner to continually evaluate if we are meeting your needs. The Bank strives to be flexible and responsive as the environment evolves and shifts.

The multitude of products and services you have access to as a member include, but aren’t limited to:

The Bank works to provide tailored solutions for each of our member institutions through our Strategies and Solutions team. You can find tools and request a consultation with that team at any time as a valued member of the Bank.

As a member, are you actively utilizing all of the customer benefits listed below? If not, what is holding you back? Again, this could be a great discussion to have with our Strategies team or your relationship manager to find the most impactful mix of our services to help your institution thrive.

We also provide many educational opportunities to stay up-to-date on industry news and insights including:

Most importantly, the Bank offers your institution liquidity on demand. As long as you have qualifying collateral in place, we will lend to you on the same day or in the future if you prefer. Our advances are a strong and stable funding source. Members have the ability to determine their term and structure, as well as if you prefer fixed or variable rate.

FHLB Des Moines advances help with asset and liability management, liquidity planning and other unexpected changes in your balance sheet. This level of access to liquidity is essential in all economic and business cycles.

Additionally, we highly recommend that each member signs up for our From the Desk newsletter. This publication gives you daily economic insight from our Strategies and Solutions team as well as the advance rates for that day.

Are you fully utilizing your customer benefits?

If you want to explore how to implement member benefits you aren’t actively utilizing, get in contact with your relationship manager.

Read part two, The Value of the Dividend, where we dive into the shareholder role and how your communities can benefit from it.

TAGS

- Membership Benefits