The Impact of the Collateralization Method for Public Unit Deposit Letters of Credit on Liquidity Ratios and Income

last updated on Monday, March 12, 2018 in Letters of Credit

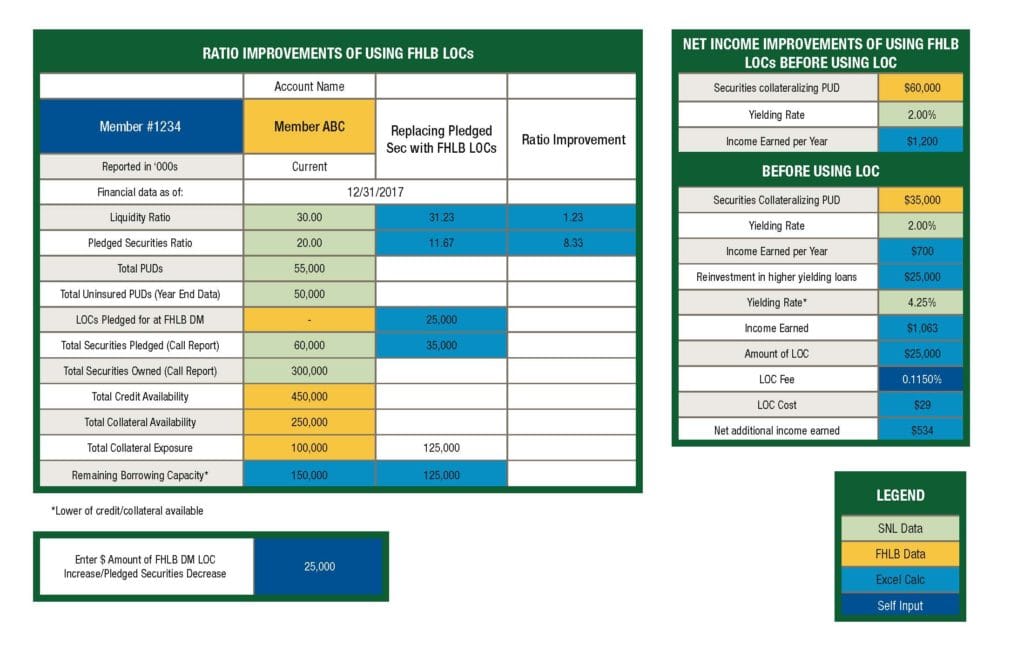

It is valuable for public unit depositories to consider the benefits of diversifying their methods of collateralization. Customized sensitivity analysis involving direction of collateralization away from securities and pledging in favor of letters of credit can yield positive results. Liquidity metrics, including pledged securities and liquidity ratios, can be optimized by reducing the amount of securities that are pledged. In addition to the liquidity benefits of using letters of credit, there is a case to build that repatriation of pledged securities can encourage a financial institution to alternatively deploy capital to higher-yielding loans or other assets. Figure 1 details a financial institution that currently funds itself with $55 million in public unit deposits. Per its call report, it owns $300 million in marketable securities. Twenty percent of its securities, or $60 million, are pledged. Assumedly, all of its $50 million in uninsured public unit deposits are backed by pledged securities.

Figure 1

This particular institution is also assumed to have a 35% credit line against its $1.286 billion in assets, or $450 million. Available remaining eligible collateral capacity is $150 million. The member would like to assess the impact of securing a portion of outstanding public unit deposits with a FHLB Des Moines Standby, irrevocable Letter of Credit that would be written in favor of the public unit, in the event the member financial institution failed to perform. Above the FDIC $250,000 insurance limit, the member has historically pledged high-quality treasury and agency securities, in this case assumed to carry a yield of 2.00%, generating an annual income of $1.20 million. The member would like to consider pledging $25 million of the security requirement in lieu of pledging securities. As such, the member would have the opportunity to redeploy capital to higher-yielding assets such as mortgages, or C&I or commercial real estate loans. In Figure 2 we'll assume that a proxy for an alternative, higher-yielding asset (perhaps SFR mortgages) at 4.25%. We would next compare the existing securities-generated income with the income from the higher-yielding asset. The $25 million transfer from pledged securities to letters of credit would encourage the institution to generate an additional $534,000 in income.

Public Unit Deposit Collateralization: Multiple Benefits to the FHLB Des Moines Member and to the Public Unit Depositor

Standby Letters of Credit issued on behalf of FHLB Des Moines members and in favor of their public unit depositors can: i) help diversify collateralization methods, ii) relieve the administrative complexities of substituting securities, iii) improve member liquidity metrics and iv) encourage members to redirect capital to core, higher-yielding assets. FHLB Des Moines is a widely accepted collateralization counterparty by public units. Feel free to contact your Relationship Manager about the specific impact that FHLB Des Moines public unit deposit Letters of Credit can have on your institution. View More on the Public Unit Deposit Letter of Credit Opportunity.

TAGS

- Collateral

- Confirming Letter of Credit

- Credit and Collateral

- Funding

- Letters of Credit

- Standby Letter of Credit

- Strategies