Know When to Hold: When's the Right Time to Keep Your Loans?

last updated on Tuesday, April 12, 2016 in Strategies

As a community lender, you know a significant opportunity exists outside the parameters of the conventional/conforming that will allow you to make profitable and high quality mortgages to some of your best and most loyal customers. Keep your loan funding in one place and enjoy easy access to mortgage lending solutions with FHLB Des Moines. Our advance solutions can assist you in any of the following situations.

Make lending decisions based on the intangibles as well as the tangibles of a transaction.

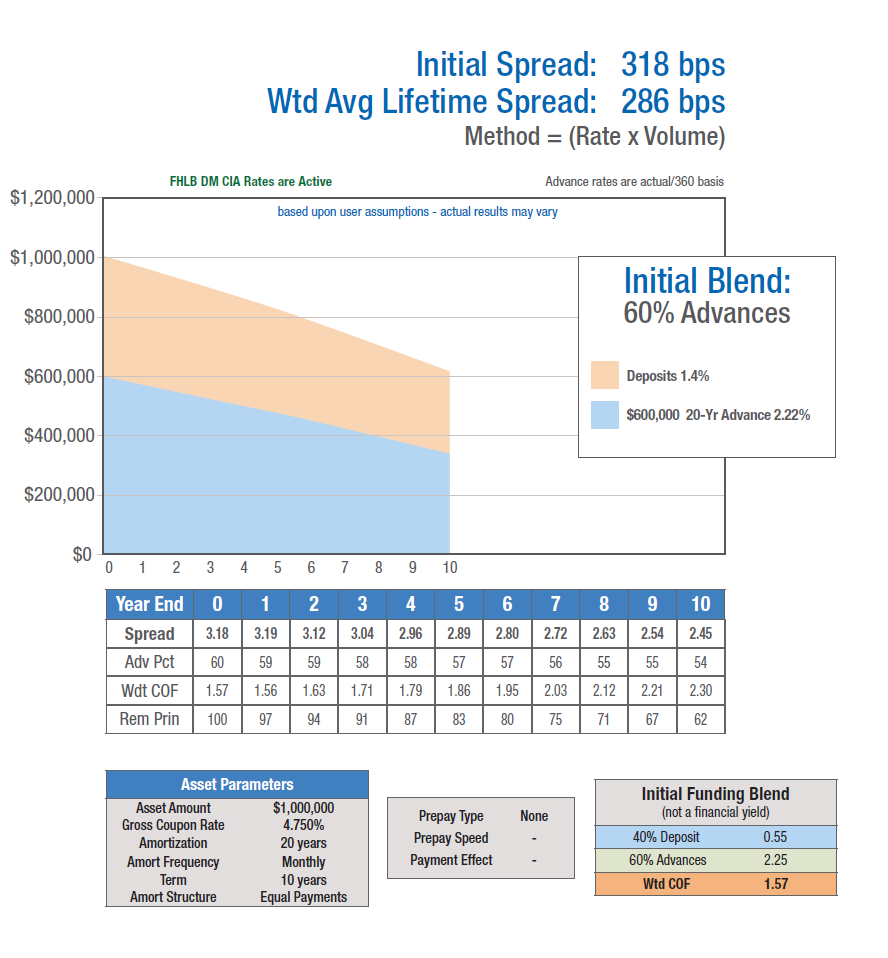

This member used a 10-year monthly Amortizing Advance on a 20-year amortization schedule to offer and portfolio a mortgage loan to one of their largest small business owners, which was considered a non-qualified mortgage. This allowed the member to retain and satisfy one of their largest customers.

Retain your best and most faithful customers, including those considered non-qualified by regulation.

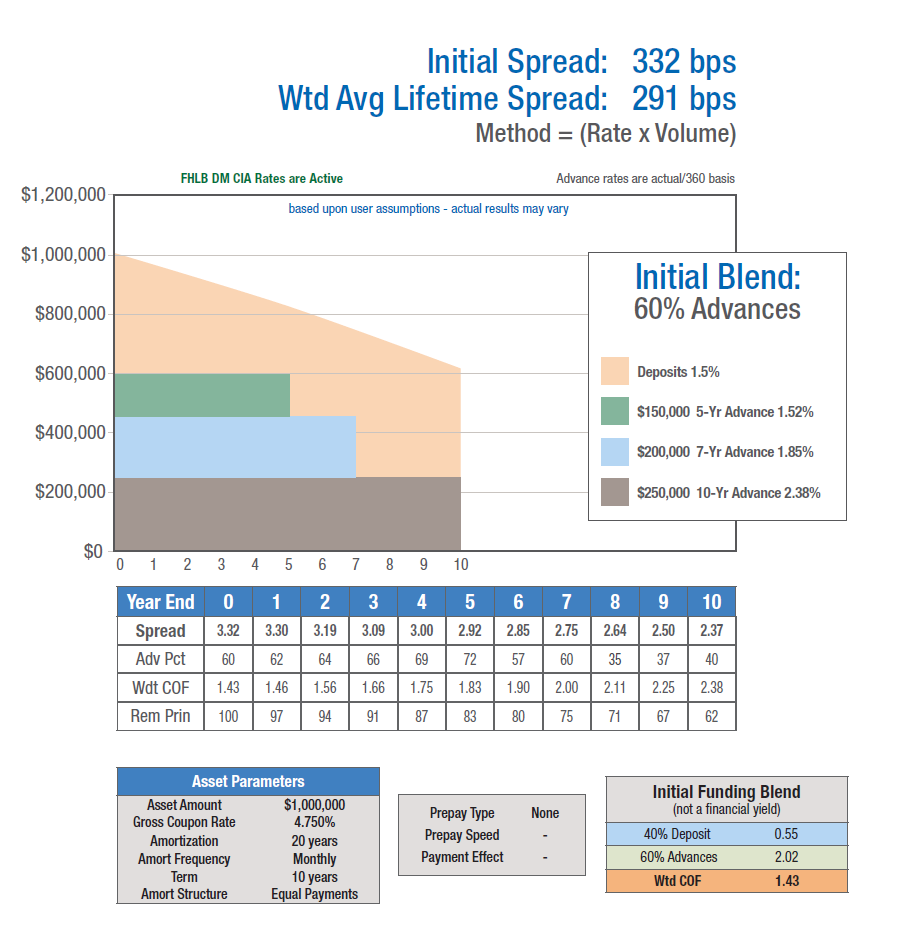

This member constructed a ladder of non-amortizing fixed-rate advances to offer and portfolio a mortgage loan to one of their largest small business owners. This allowed the member to retain and satisfy one of their largest customers.

Make and hold adjustable rate, balloon, single-pay, long-term fixed-rate and/or non-conforming loans.

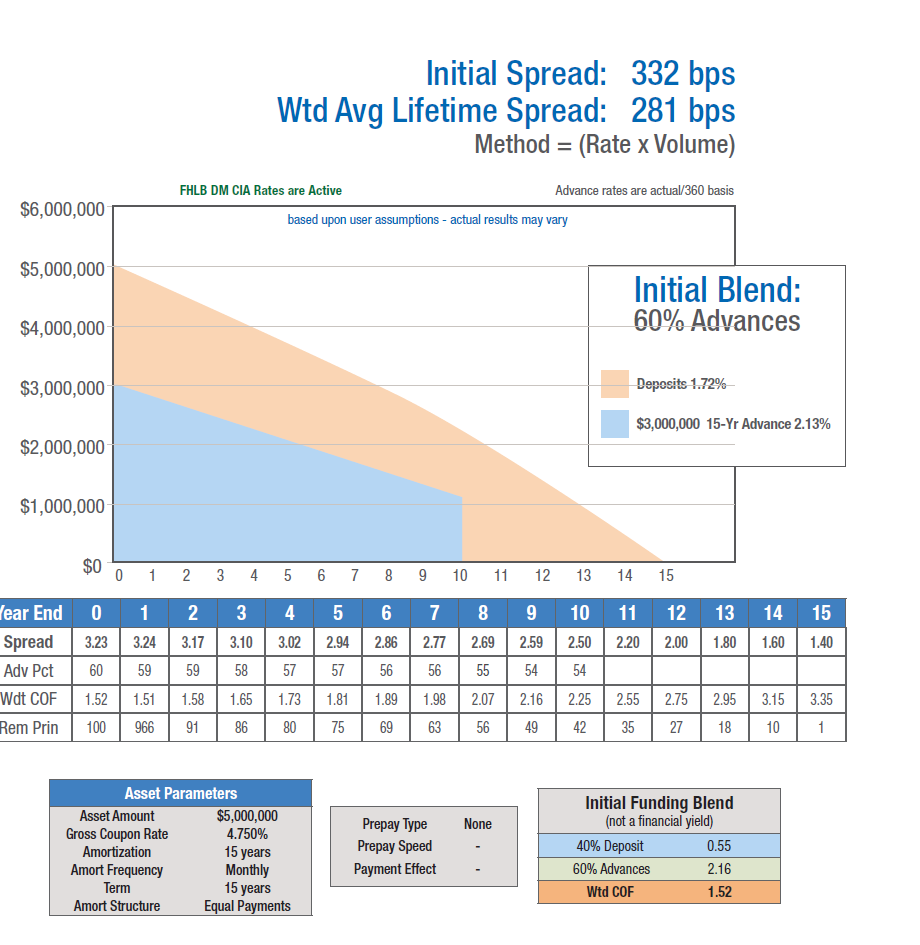

This member used a 10-year monthly Amortizing Advance with a 15-year amortization schedule to match the cash flow characteristics of a pool of 15-year mortgages. The member chose to portfolio some customer mortgage loans and used FHLB Des Moines advances to assist in building margin and mitigating interest rate risk.

TAGS

- Funding

- Mortgage

- Solutions