Quick Reference Guide for Completing your Community Investment Advance (CIA) Application

last updated on Tuesday, July 30, 2019 in Affordable Housing

1. Separate applications for residential and commercial advances.

Advances for owner-occupied and rental residences use the residential advance application. Commercial and agricultural lending use the commercial application. Forms are available on the website. We have improved the PDF forms to allow you to fill out on-screen. Complete an application and save, print and fax to the Bank using the number on the form. Allow 24 hours for processing the advance request.

APPLICATIONS

2. Qualifying loans for the CIA application and pledging loans to meet collateral requirements are two separate processes.

As with all advance products, FHLB Des Moines members must meet credit and collateral requirements of the Bank. To obtain a CIA advance, members must identify qualifying loans or other assets, but those loans are not pledged as collateral in that process. The member’s current pledged collateral will be used to facilitate the advance.

The loans used to qualify for the CIA may also meet the Bank's collateral eligibility guidelines and can therefore be pledged to FHLB Des Moines as collateral.

Instruction for qualifying loans to obtain an advance, and information requirements for eligible loans is included in each of the applications forms available on the website.

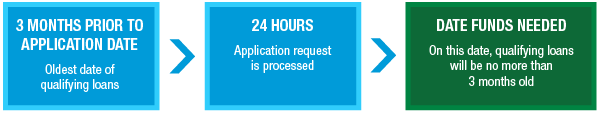

3. An application expiration date will be determined based on the qualifying loan close date. Take down funds promptly.

A qualifying closed loan can be no more than 3 months old the date of the advance, thus:

Example

- In the CIA application, oldest date of qualifying loan: June 25, 2019

- Application Expiration Date: September 25, 2019 - 3 months after loan date

- CIA advance must be requested by the member by the expiration date through the Money Desk.

For loans to be closed, the expiration date will be 30 days after the date the application is received. Members have 12 months to close qualifying loans after the advance.

NOTE: An approved application does not lock an interest rate or reserve funds. Interest rate is determined at the time of the advance.

more information on community investment advances

Questions about Community Investment Advances? Contact the Community Investment Department at 800-544-3452, ext. 2400 for assistance.