How Can the Impact of Rising Rates on Your Investment Portfolio's Market Value Come Out in the Wash?

last updated on Thursday, June 21, 2018 in Advances

Rising Rates and the Impact on Portfolio Market Value

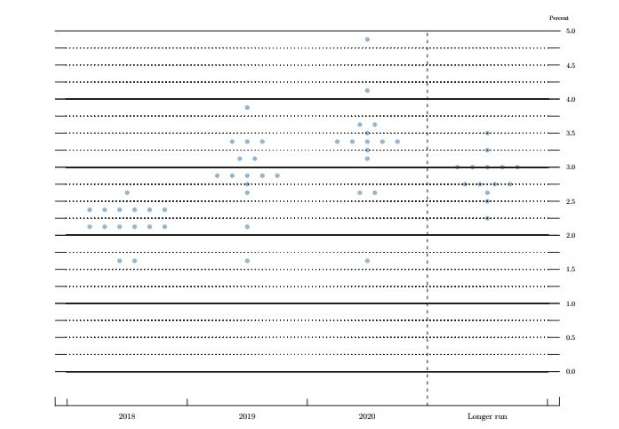

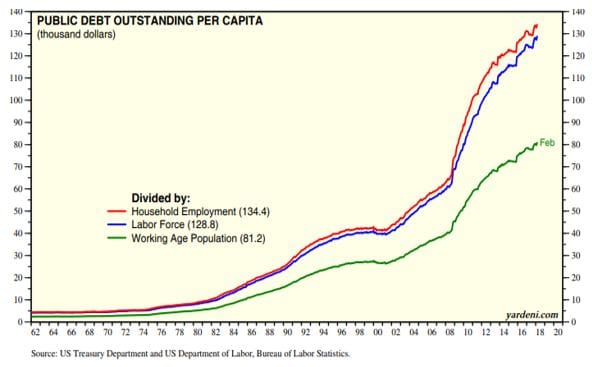

We've been here before. Exactly five years have passed since the 2013 “taper tantrum” that was precipitated by the Federal Reserve's mere mention of the wind-down of the central bank's long-time asset purchase program. During this time, the fixed income markets unraveled, investment portfolio market values diminished and members of the regulatory community challenged financial institutions to support increased capital levels as a result of deteriorating investment values. Today, while no one can be certain of the direction of interest rates, the short-end of the yield curve is under the heavy influence of well-telegraphed Fed tightening. As of March 2018, members for the Federal Open Market Committee were projecting the Fed fund's rate to gravitate in the 3.25% to 3.50% range during 2020 (Figure 1). Coincidentally, although the yield curve has been relatively flat, public debt levels (Figure 2) have expanded non-linearly in recent years, causing concern for rising rates in the longer-end of the yield curve.

Figure 1. Federal Open Market Committee's assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate. Source: Federal Reserve, March 21, 2018

Figure 2: Historical Levels of Public Debt by Various Per Capita Measures

As market values erode on the left-hand side of the balance sheet, it's interesting to examine if it is possible for the right-hand side of the balance sheet to create offsetting gains in value. With a little help on the funding side, the answer can be “yes.” In a rising rate environment, the theoretical value of a fixed income investment erodes, more so as the duration of the investment or portfolio extends. Conversely and conceptually, if rates were to increase, a debt issuer or borrower whose coupon was set during a time of lower rates should be in the position of gaining additional market value.

Developing a Funding Counterweight to Declining Investment Market Value

Although investments that are classified as “Available for Sale” or “Held to Maturity” need not immediately have their market values flow directly to net income, their intrinsic values will rise and fall based on interest rate levels. The same phenomenon should hold true for liabilities, yet the asymmetrical properties of many funding sources prevent realization of intrinsic value from being exercisable when rates rise. In theory, a debt issuer should be in the position of prepaying funding and gaining a credit for the debt's intrinsic value if prevailing interest rates are materially above the rate at which the debt was originally issued. What prevents the exercise of intrinsic value of funding is often found in the contractual terms of the funding instrument. Many sources of term funding, ranging from brokered CD's to indeed, “asymmetrical” term advances do not enable issuers to exercise intrinsic value prior to maturity in the form of a credit at the time of prepayment. Consider the case of the symmetrical advance. Let's examine the impact of using symmetrical funding properties as an alleviant to investment portfolio market value erosion in a time of rising rates.

The Symmetrical Advance

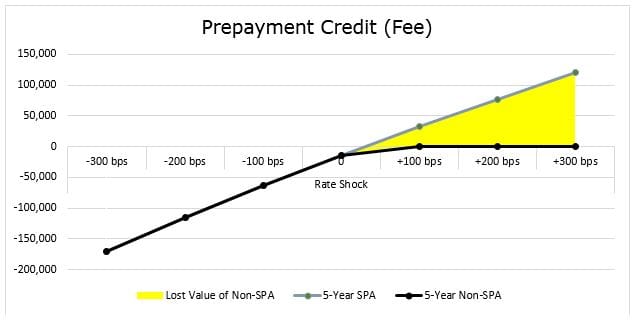

In brief, the symmetrical prepayment advance allows an issuer to recognize a gain in the event it is prepaid in an interest rate environment that is higher than the rate environment that existed when the advance was originated, via terminating the funding prior to contractual maturity. To realize this monetary value, the borrower would simply need to prepay the advance prior to its contractual maturity. Again, a pre-requisite for extracting any intrinsic value of the advance would be a function of the degree of material difference in rates between original issuing and prevailing levels and the time remaining to contractual maturity. At present, the incremental cost of a symmetrical advance's contractual feature is small when compared with rates on standard asymmetrical structures. An asymmetrical structure would simply be an advance that, if rates were to rise, would not carry a contractual feature that would allow a borrower to extract intrinsic value in the event rates were to rise. Above a certain rate level, in the event of a prepayment, a borrower would only be paid back at par, in spite of the fact that there may be intrinsic value in the below-market coupon advance. That is why most forms of funds are “asymmetrical.” Mechanically, the amount of a prepayment credit (should rates rise from the initial borrowing rate) would be calculated in the same manner as a traditional or asymmetrical advance prepayment fee would be calculated (should rates decline relative to the time of origination). Figure 3 shows the lost value (in the yellow), or opportunity loss associated with the difference between an asymmetrical and a symmetrical advance, using the example of a five-year maturity advance under a rising rate environment. As an example, under a rate rise of 200 bps, a $1 million notional advance would represent a $77,358 credit vs. an asymmetrical advance that would not carry a credit at all. With a symmetrical feature, the borrower could simply pre-pay the advance and have their DDA credited for the $77,358 of intrinsic value. Conversely, if interest rates were to decline, a member, if they elected to prepay an advance, would do so irrespective of the symmetrical prepayment feature being in place. However, if interest rates were to rise, a credit could be applied to an advance with symmetrical prepayment feature, allowing a member to repay the advance at an amount below the outstanding par value.

Figure 3. Example of the Prepayment Credit and Fee Impact on Advances With and Without the Symmetrical Feature

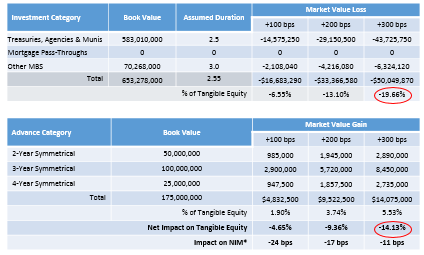

Hedging the Investment Portfolio Using Symmetrical Funding

Symmetrical advance funding can be an effective means of offsetting losses in fixed-rate investments caused by higher interest rates, or for that matter, mortgages, loans and even credit losses. As an example, as illustrated in Figure 4, consider a sample $653 million book value portfolio consisting of 583 units of treasuries, agencies and municipal securities, along with 70 units of mortgage-backed securities. The portfolio has a duration of 2.55 years. Again, the longer the duration, the more susceptibility to market value loss as a result of rising rates. Under varying instantaneous parallel rate shocks, we can see the market value loss that accumulates as rates rise – is almost 20% deterioration in an up 300 bps scenario. This phenomenon is what has historically concerned the regulatory community in terms of available liquidity and capital. Alternatively, consider the simultaneous impact, this time on the positive side, of booking as a partial offset, $175 million in the form of a ladder of 2/3/4-year symmetrical advances. In an up 300 bps scenario, the detriment caused by rising rates is somewhat cushioned, resulting in a net market value loss of approximately 14%. While we are incrementally paying 11 bps in NIM impact in an up 300 bps scenario, we are recouping about 25% of the hit that we would otherwise take to tangible equity.

Figure 4. Example Market Value Impact of Rising Rates on an Investment Portfolio that is Partially Funded with a Ladder of Symmetrical Term Advances vs. an Investment Portfolio without Symmetrical Term Advance Funding

The analysis demonstrated by Figure 4 shows that the losses in the investment portfolio continue to increase the higher rates move, leading to substantial losses on the portfolio. However, by implementing a laddered funding structure of symmetrical prepayment advances for a portion of the investment portfolio, an investor can limit the net impact of rising rates as measured by the portfolio's net market value, and ultimately the institution's tangible equity.

Customizing the Symmetrical Funding Strategy

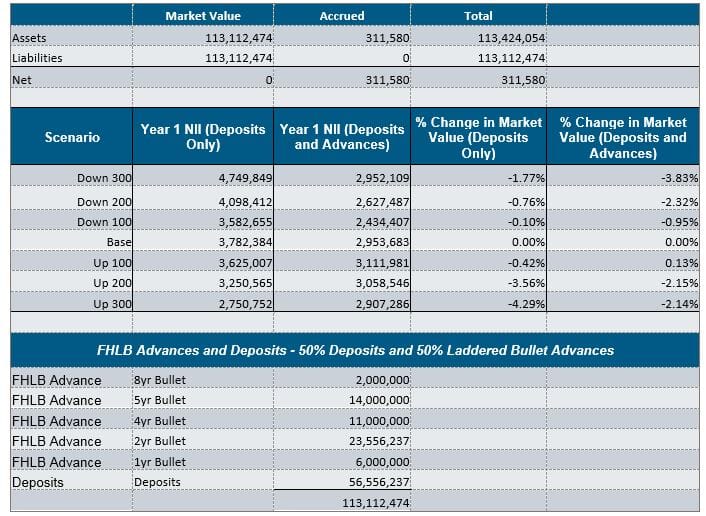

It is useful to model various combinations of symmetrical advance ladders and build them into blended funding scenarios that also incorporate deposits as a complementary source of funding. Figure 5 demonstrates the impacts of various instantaneous rate shifts on a portfolio that is funded by a blend of symmetrical advances and deposits, versus one that is funded solely by deposits. Again, the outputs are measured by impact on net market value and net interest income. Figure 5 represents a $113 million investment portfolio that is one-half funded by a 1,2,3,4,5,8-year ladder of symmetrical advances, and one-half funded by deposits, versus the same portfolio that is solely funded by deposits. Reflecting on the up 300 bps case, a blended symmetrical/deposit strategy shows a net interest income figure that would be $157,000 better than funding the portfolio strictly with deposits ($2.907m vs. $2.750m). Market value would be projected to deteriorate by 2.14% under a blended funding scenario versus a deposits-only scenario deterioration of 4.29%. Alternatively, should rates not change, under the net interest income measurement, the portfolio would better off by $829,000 under a deposits-only scenario, with no change in market value. For all intents and purposes, that's the opportunity cost of the portfolio's insurance premium against rising rates. A portfolio manager would effectively have the opportunity cost of the premium offset as rates rise.

Figure 5. Impact of Different Rate Scenarios on a Sample Investment Portfolio's Net Interest Income and Market Value Under a 50% Deposit and 50% Ladder of Five Different Symmetrical Advances vs. a Deposits-Only Funding Scenario

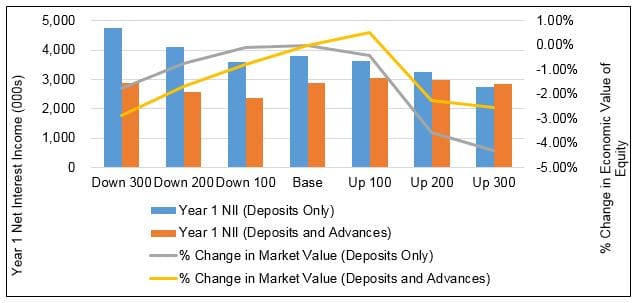

Figure 6. Impact of Different Rate Scenarios on a Sample Investment Portfolio's Net Interest Income and Market Value Under a 50% Deposit and 50% Ladder of Five Different Symmetrical Advances vs. a Deposits-Only Funding Scenario (Graphical Depiction)

Shown graphically as an example in Figure 6, as rates rise, the market value erosion under the blended funding scenario is less damaging than in the deposits-only scenario. On the basis of net interest income, the performance of the blended funding approach is actually better than under the deposits-only case under a rate shock of +300 bps. Why? The duration-certainty of adding the structured advances to the funding portfolio is emphasized. With the assistance of your Relationship Manager and the Member Strategies team at the Federal Home Loan Bank of Des Moines, it's easy to model multiple combinations of funding blends and symmetrical advance ladders.

Coming Out in the Wash

CommunityAmerica Credit Union, a member of the Federal Home Loan Bank of Des Moines, recently placed its symmetrical funding balance sheet funding strategy into action. Several years ago, CommunityAmerica took on $30 million in term symmetrical advances in order to hedge a portfolio of bullet agency investments. Michael Garrett, Treasurer, commented, “As rates have risen recently, we prepaid the symmetrical advance and sold the agency securities at a loss and replaced them with current coupons. Thanks to the gains from the extinguishment of the symmetrical advance, we were able to mitigate the net loss of the investment sale and enable our margins to be meaningfully enhanced going forward.” Since the financial crisis of 2008, depository institutions across the nation have experienced significant increases in liquidity and balance sheet growth. Much of this liquidity has been deployed in securities. Since 2008, increases in security portfolios account for 55% of bank balance sheet growth and 25% of credit union balance sheet growth. Slackening post-crisis loan demand and significant margin compression caused many financial institutions to seek additional return by investing further out on the yield curve, exposing them to duration risk. As an example, to shield risk-based capital from potential unrealized securities losses, some institutions increasingly categorized securities as Held to Maturity (HTM). Although unrealized securities losses in HTM portfolios are not captured in regulatory capital calculations, such losses could still give regulators pause when assessing perceived adequate levels of capital. Market values of advances with the symmetrical prepayment feature bear an inverse relationship to fixed-rate security portfolio valuations. Therein lies the benefit: In a rising rate environment, advances with the symmetrical prepayment feature can create unrealized gains on the liability side of the balance sheet which can be monetized. These unrealized gains could be perceived as an offset to unrealized losses in security portfolios. In reality, it can all (or partially) “come out in the wash.”

TAGS

- Advance Solutions

- Advances

- Balance Sheet

- Funding

- Strategies

- Yield Curve