“Blend and Extend” Funding Strategies: An Effective Means of Decreasing Future Funding Costs, Customizing Balance Sheet Duration and Pre-Funding

last updated on Wednesday, July 3, 2019 in Advances

With interest rates having dropped for much of the first half of 2019, it’s worthwhile for financial institutions to monitor their soon-to-be-maturing advances with Federal Home Loan Bank of Des Moines (FHLB Des Moines). A number of factors may influence your decision to refinance advances, including: liquidity projections associated with loan and deposit growth, interest rate sensitivity or your view on future interest rates. While most financial institutions typically make the decision to roll the maturity at the time the advance matures, in certain circumstances, members of FHLB Des Moines have the ability to extend the advance prior to the maturity date.

“Blend and Extend”

Depending upon accounting treatment members may be able to extend the maturity and reduce the rate of existing advances. This restructuring strategy is sometimes referred to as “Blend and Extend.” Essentially, the prepayment fee of an existing advance is blended into the rate of a new advance as the duration of the existing advance is extended. As such, there is no need to wait for the existing advance to mature in order to renew your funding requirements. There would be no cash settlement of the prepayment fee since it would be blended into the rate of the new advance. So, the blending and extending of an outstanding advance could allow a member to extend the maturity of an advance at a lower rate without requiring additional cash or the purchase of additional FHLB Des Moines stock.

Why might it make sense for an institution to consider whether a “Blend and Extend” strategy is a good fit? There are a number of possible benefits, including:

- In an environment in which a new interest rate would be lower than an existing interest rate, future interest margins could be favorably enhanced.

- Funding gaps could be filled with a new advance with a maturity ranging from two-to-20 years.

- If your internal projections called for rising rates, immediately extending the term of an existing advance could give a member the opportunity to pre-fund before rates actually increase.

- Liability-sensitive institutions or those that desire additional asset-sensitivity could benefit from the ability to extend liability duration without increasing balances.

The Mechanics of Advance Restructuring

The process of “blending and extending” an outstanding advance is not terribly different than that of prepaying an advance; with one exception: Once the transaction is completed, there is no cash payment of the prepayment calculation at the time the transaction is completed. While the prepayment calculation remains based on the present value of the remaining cash flows of the existing advance, there is no additional fee or premium associated with a “Blend and Extend” strategy (aside from the interest payment due for the existing advance upon prepayment). Instead, the present value of the cash flows of the extinguished advance are simply incorporated into the calculation of the interest rate of the new advance.

Federal Home Loan Bank of Des Moines does not offer nor provide any accounting guidance regarding advance restructuring, it is necessary for a member to determine if the advance restructuring would be accounted for as either: i) a modification of debt, or ii) an extinguishment of debt. The determining factor would be the magnitude of the difference in the present value between the new and the old advance, using the coupon rate on the old advance as the operative discount rate. As a general guide, an advance restructuring is interpreted as a modification of debt if the difference between the present value of the two advances is less than 10%. Again, as each situation is customized and must be suitable for each institution, it’s best to discuss the accounting ramifications of an advance restructuring, including ASC 470-50 with your internal and external accounting teams.

Under the scenario of a debt modification, prepayment charges would accrete over the term to maturity of the new advance. Under a debt extinguishment, the rate difference between the old and new advance would be booked as a one-time prepayment charge.

Example of a “Blend and Extend” Advance Restructuring Program

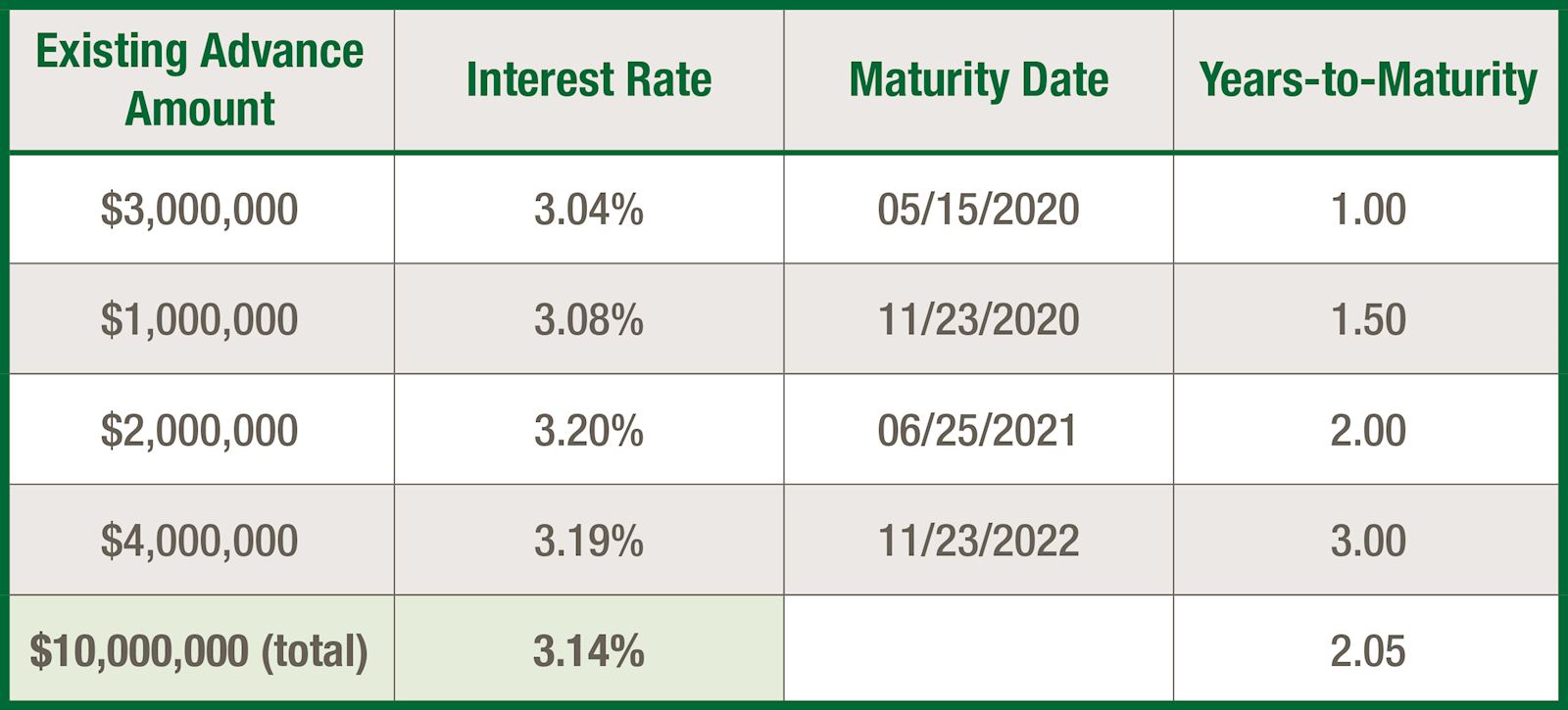

Consider the case of a financial institution that would like to extend liability duration and reduce the future cost of its funding without increasing the size of its balance sheet. Figure 1 describes a portfolio of existing term bullet advances of a financial institution, representing a total of $10 million in original advance funding, with a respective weighted rate of 3.14% and weighted maturity of 08/27/2021, or 2.05 years.

Figure 1. An Example Portfolio of Existing Term Bullet Advances

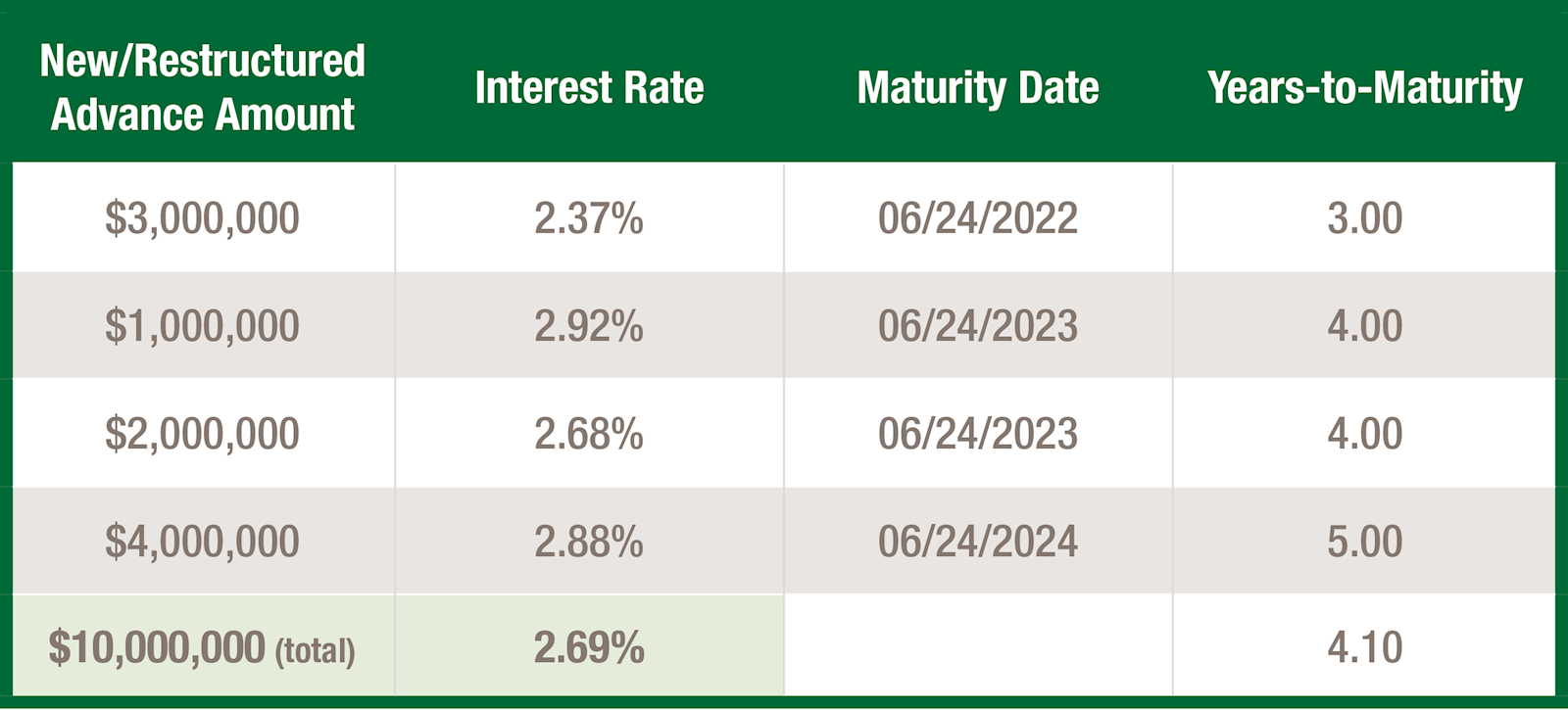

Similarly, Figure 2 shows a proposed slate of new advances, still representing a total of $10 million in advance funding, now with a respective weighted rate of 2.69% and maturity of 4.10 years. The new blended rate of 2.69% would be slightly higher than the weighted average rate for standard posted advances. Why? Any pre-payment assessments would be absorbed into the amortization of the advance rate to term. In this instance, although funding balances remain at $10 million, the weighted rate on the funding decreases from 3.14% to 2.69%; 45 basis points below the cost of the current funding ladder. The funding portfolio’s years-to-maturity increases from 2.05 years to 4.10 years. The financial institution would decrease its annual funding costs by $45,000.

Figure 2. An Example Portfolio of New/Restructured Term Bullet Advances

The Benefits of “Putting it in the Blender”

Whether you are interested in locking in a rate, lowering a rate, extending the term of your current advance or some combination of the three, advance restructuring can help you achieve your goal. If you would like to learn more about how advance strategies might help you manage your institution’s balance sheet, feel free to contact your FHLB Des Moines Relationship Manager or the Strategies team in order to identify advances that are in your funding portfolio that might be suited for replacement and restructuring. For more details about restructuring advances, please see the Advance Restructuring page.

TAGS

- Advance Restructuring

- Advances

- Strategies