Effective January 2, 2019 - New Collateral Definitions and Reporting Requirements

last updated on Wednesday, August 1, 2018 in Business News

Return to Collateral Information

Beginning in 2019, the Federal Home Loan Bank of Des Moines will implement the following changes to collateral definitions and procedures for pledging and reporting of nontraditional and subprime loans.

This change will allow members to more accurately pledge and report their residential 1-4 family first mortgage loans.

Quickly find information on:

Changes to Collateral Pledging and Reporting Requirements

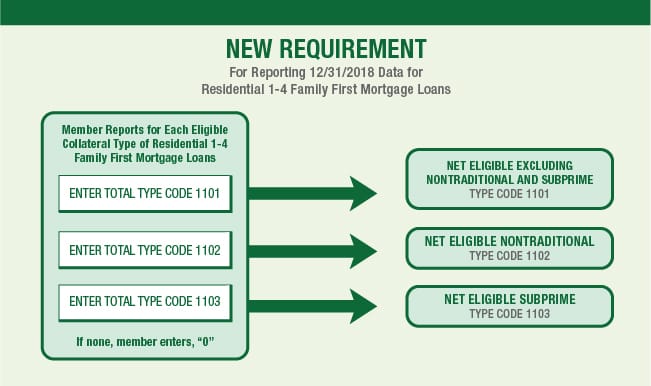

Beginning January 2019, Blanket APSA members pledging or reporting eligible residential 1-4 family first mortgage loans for collateral will be required to self-report the dollar amounts for loans that meet the Bank's definition of nontraditional and/or subprime, in addition to the net total of residential 1-4 family first mortgage loans excluding nontraditional and subprime.

(1/2/19 Update) The Getting Started Guide (BBCs) (Depository Members - Blanket APSA) has been updated to reflect the changes to the BBC.

To learn more about the details of this new reporting requirement and how it will change from the current procedure, please refer to the Member Self-Reporting FAQ Guide.

Frequently Asked Questions

Monthly Loan Listing

Members listing loans using the General File Format should use type codes 1102 for nontraditional loans and 1103 for subprime loans beginning with 12/31/2018 data.

UPDATE (8/13/18) – Additional details for loans with no FICO score

Subprime loans will be identified using FICO score first (per definition), and secondary indicators only when a FICO score was unavailable at origination.

Loans should be reported as Subprime if at origination:

- FICO ≤ 660;

- FICO score is not available and the loan exhibits a subprime characteristic1; or

- No FICO score or credit history is available and there is insufficient evidence of assessment (i.e. no credit report or cash flow analysis is available).

Update (11/14/18) - Preview changes to the BBC form as a result of this new reporting requirement

Video is best viewed in HD (720p). This video has no sound.

What Will Change from the Current Requirement?

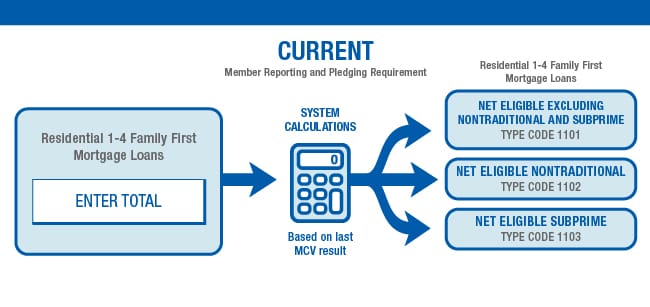

Currently, members are only required to report the total dollar amount for residential 1-4 family first mortgage loans and then, based on the member's last Member Collateral Verification (MCV) results, a calculation is made from the member's reporting that breaks out a defined percentage into type code 1101 (residential 1-4 family first mortgage loans excluding nontraditional and subprime), type code 1102 (nontraditional) and type code 1103 (subprime). This reporting requirement will change beginning with pledging and/or reporting of 12/31/2018 data for residential 1-4 family first mortgage loans.

Contact Us

Your FHLB Des Moines Collateral Team is ready answer any questions you may have regarding these changes.

800.544.3452 ext. 2500

AdvanceCollateral@fhlbdm.com

Frequently Asked Questions

The FAQ document was last updated on December 31, 2018.

FICO is a registered trademark of Fair Isaac Corporation

1 At origination or most recent modification, evidence of delinquency (two or more 30-day delinquencies in the last 12 months or one or more 60-day delinquencies in the last 24 months); evidence of foreclosures or judgments in the prior 24 months; evidence of bankruptcy in the prior 60 months; or a DTI ratio of 50% or greater.

- Credit and Collateral