Legislative Update - 4/14/2021

last updated on Wednesday, April 14, 2021 in Public Policy Network

The Public Policy Newsletter (PPN) provides our latest analysis and updates from Washington, D.C.

Your input matters and is critical to our success. Please let us know your thoughts and how we can better serve you. Feel free to email our Government Relations team with any feedback. (Joe Cwiklinski, VP/Director of Government Relations or Amber Pringnitz, Government Relations Manager)

Issue Analysis and Updates

American Jobs Plan

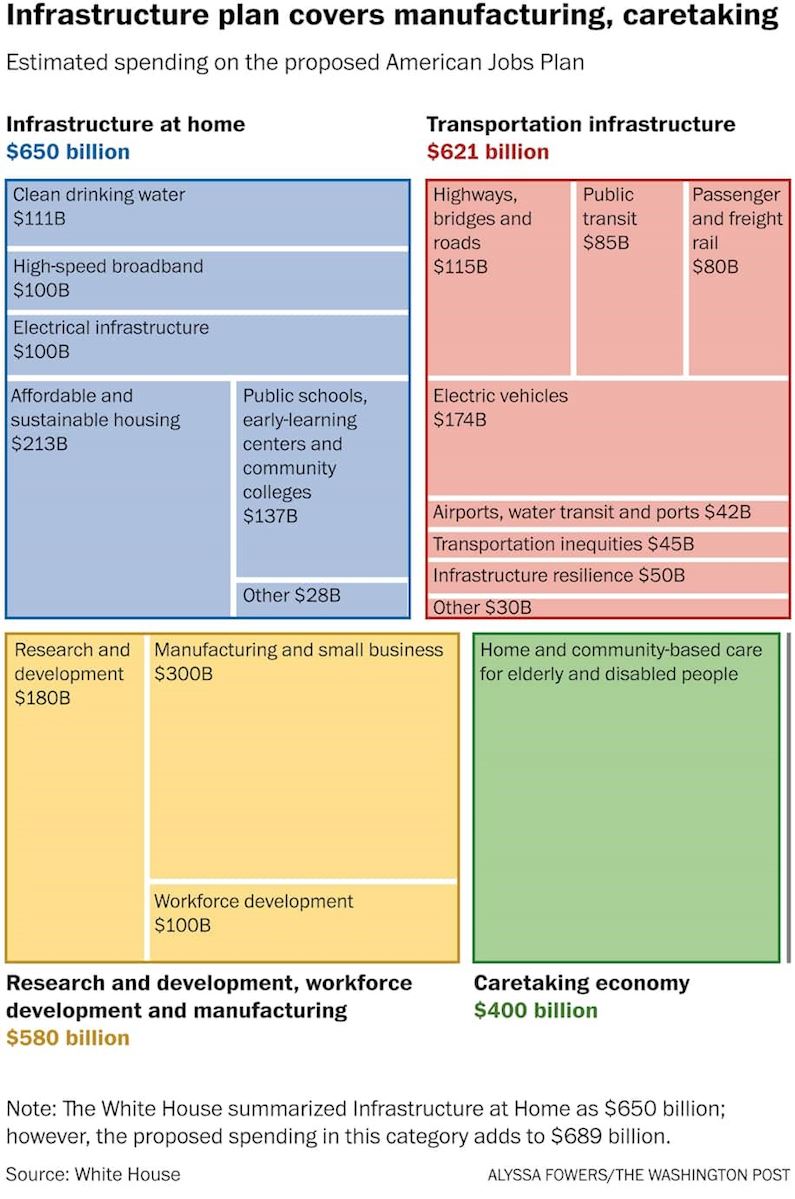

On March 31, President Biden released his $2.25 trillion American Jobs Plan. The proposal provides $621 billion for transportation infrastructure, $650 billion for infrastructure at home, $580 billion for research and development, workforce development and manufacturing, and $400 billion for the caretaking economy.

The link to the White House fact sheet on the full proposal can be found here. Also, below is a table from the Washington Post that provides an overview of the plan.

Pay-fors

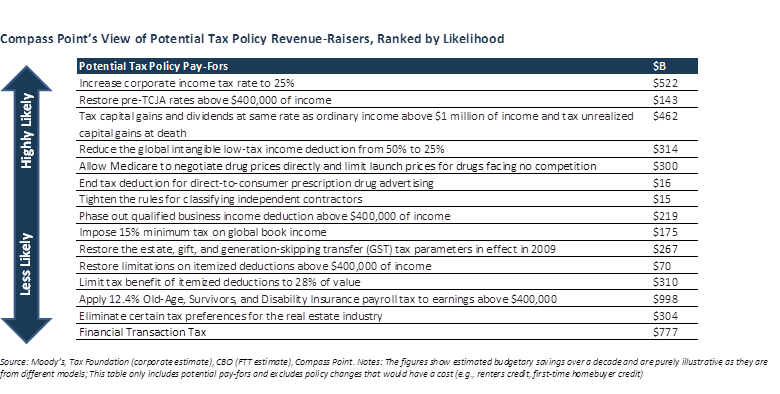

The American Jobs Plan calls for $2.25 trillion in new funding to be spent over eight years paid for by several tax increases over 15 years. So far, the plan proposes raising the corporate tax rate from 21 percent to 28 percent and ending federal tax breaks for fossil fuel companies.

The White House is expected to propose additional pay-fors later this month.

The following chart from Compass Point outlines several tax provisions being discussed and the likelihood they will eventually be adopted by Congress.

Republican Reaction

Senate Minority Leader Mitch McConnell said the $2.25 trillion plan “is not going to get support from our side.” According to McConnell, “I'm going to fight them every step of the way, because I think this is the wrong prescription for America.”

Senator Roy Blunt (R-MO) said President Biden could get bipartisan support if he cut his $2.25 trillion proposal to $615 billion and focused on traditional infrastructure defined as “roads and bridges and ports and airports, and maybe even underground water systems and broadband.”

According to Blunt, "I think there's an easy win here for the White House if they would take that win."

Outlook

It’s unlikely though that the White House and Democratic Congressional leadership would be willing to cut the proposal by so much.

It’s more likely that Democratic leadership will not rely on Republican votes and seek to advance President Biden’s proposal through Reconciliation.

Reconciliation is a parliamentary process that allows legislation to advance in the Senate by a simple majority and avoid the 60-vote threshold otherwise needed to end debate.

Because the Senate is currently tied at 50-50, using Reconciliation would require the support of all 50 Democratic Senators (without any Republican support). This could give more moderate Democratic Senators a larger say in what Congress ultimately passes.

Senator Manchin (D-WV) recently said he could support raising the corporate tax rate from 21% to 25%, but not to 28% as proposed by President Biden.

Reconciliation Limits

Reconciliation has its limits. Only legislation that directly impacts federal spending or revenues (i.e. taxes) is germane in a Reconciliation bill.

Increasing the minimum wage was not included in the $1.9 trillion COVID Relief Reconciliation bill that Congress passed last month because the Senate Parliamentarian ruled it was not germane.

How many times can Reconciliation be used?

Reconciliation can generally only be used once a year after Congress passes a Budget Resolution.

Because Congress did not pass a Budget Resolution last year, it planned to pass two Budget Resolutions (FY2021 and FY2022) this year allowing for Reconciliation to be used twice.

More than twice?

The Senate Parliamentarian, however, recently ruled that Reconciliation could potentially be used even more times in a given year.

Senate Majority Leader Schumer argued earlier this month that Section 304 of the Congressional Budget Act provides allows Congress to amend a previously passed Budget Resolution which would allow Congress to use Reconciliation multiple times in year.

Specifically, Section 304 reads: “At any time after the concurrent resolution on the budget for a fiscal year has been agreed to pursuant to section 301, and before the end of such fiscal year, the two Houses may adopt a concurrent resolution on the budget which revises or reaffirms the concurrent resolution on the budget for such fiscal year most recently agreed to.”

Bottom Line

It is still not clear what the ruling means for exactly how many more times Majority Leader Schumer could use Reconciliation this year, but it potentially sets up Reconciliation to be used at least more than twice.

Instead of everything being included in one big bill, it appears that Majority Leader Schumer will have the option to break the American Jobs Plan into at least two maybe more smaller Reconciliation bills.

More Manchin

Despite the ruling, Majority Leader Schumer may receive some pushback from within his own party for relying on Reconciliation too much.

In an op-ed last week, Senator Manchin (D-WV) wrote, “I do not believe budget reconciliation should replace regular order in the Senate.” He also said he would oppose efforts to “eliminate or weaken the filibuster.”

Majority Leader Schumer could not afford to lose any Democratic votes in the Senate which is 50-50.

The Democratic majority in the House is 218-211 due to several unfilled vacancies. As it stands currently, Speaker Pelosi could not afford to lose more than three House Democratic votes.

Something to watch going forward is how progressives and centrists will influence what Congress ultimately passes.

Congressional Hearings

Congress this week has begun to hold hearings on President Biden’s American Jobs Plan. The House Financial Services Committee is holding a hearing on the topic today.

Below is a list of all House Financial Services Committee hearings planned for April. All hearings can be live streamed here.

The Senate Banking Committee has announced two hearings for April.

- On April 15th, the Senate Banking Committee will hold a hearing entitled “21st Century Communities: Public Transportation Infrastructure Investment and FAST Act Reauthorization”

- On April 20th, the Senate Banking Committee will hold a hearing on “An Economy that Works For Everyone: Investing in Rural Communities.”

April 14 at 10:00 AM ET: The full Committee will convene for a virtual hearing entitled, "Building Back Better: Examining the Need for Investments in America's Housing and Financial Infrastructure."

April 15 at 10:00 AM ET: The Subcommittee on Consumer Protection and Financial Institutions will convene for a virtual hearing entitled, “Banking Innovation or Regulatory Evasion? Exploring Trends in Financial Institution Charters.”

April 15 at 2:00 PM ET: The Subcommittee on Investor Protection, Entrepreneurship and Capital Markets will convene for a virtual hearing entitled, “The End of LIBOR: Transitioning to an Alternative Interest Rate Calculation for Mortgages, Student Loans, Business Borrowing, and Other Financial Products.”

April 20 at 10:00 AM ET: The full Committee will convene for a hybrid markup.

April 27 at 12:00 PM ET: The full Committee will convene for a virtual hearing entitled, “Member Day Hearing: Committee on Financial Services.”

April 28 at 12:00 PM ET: The Subcommittee on Oversight and Investigations will convene for a virtual hearing entitled, “Examining the Role of Municipal Bond Markets in Advancing – and Undermining – Economic, Racial and Social Justice.”

April 29 at 12:00 PM ET: The Subcommittee on Diversity and Inclusion will convene for a virtual hearing entitled, “Closing the Racial and Gender Wealth Gap Through Compensation Equity.”