Funding Strategies to Protect Yourself Against Interest Rate Risk

last updated on Wednesday, June 2, 2021 in Advances

As the economic headwinds from the COVID-19 pandemic begin to subside, many financial institutions are taking a closer look at how to best position their balance sheets to mitigate net interest margin compression and prevent underperformance in a rising rate environment.

Consider the three funding examples below and how they might apply to your institution.

Contact your Relationship Manager to request a custom analysis to arrive at the best solution for your customer and institution.

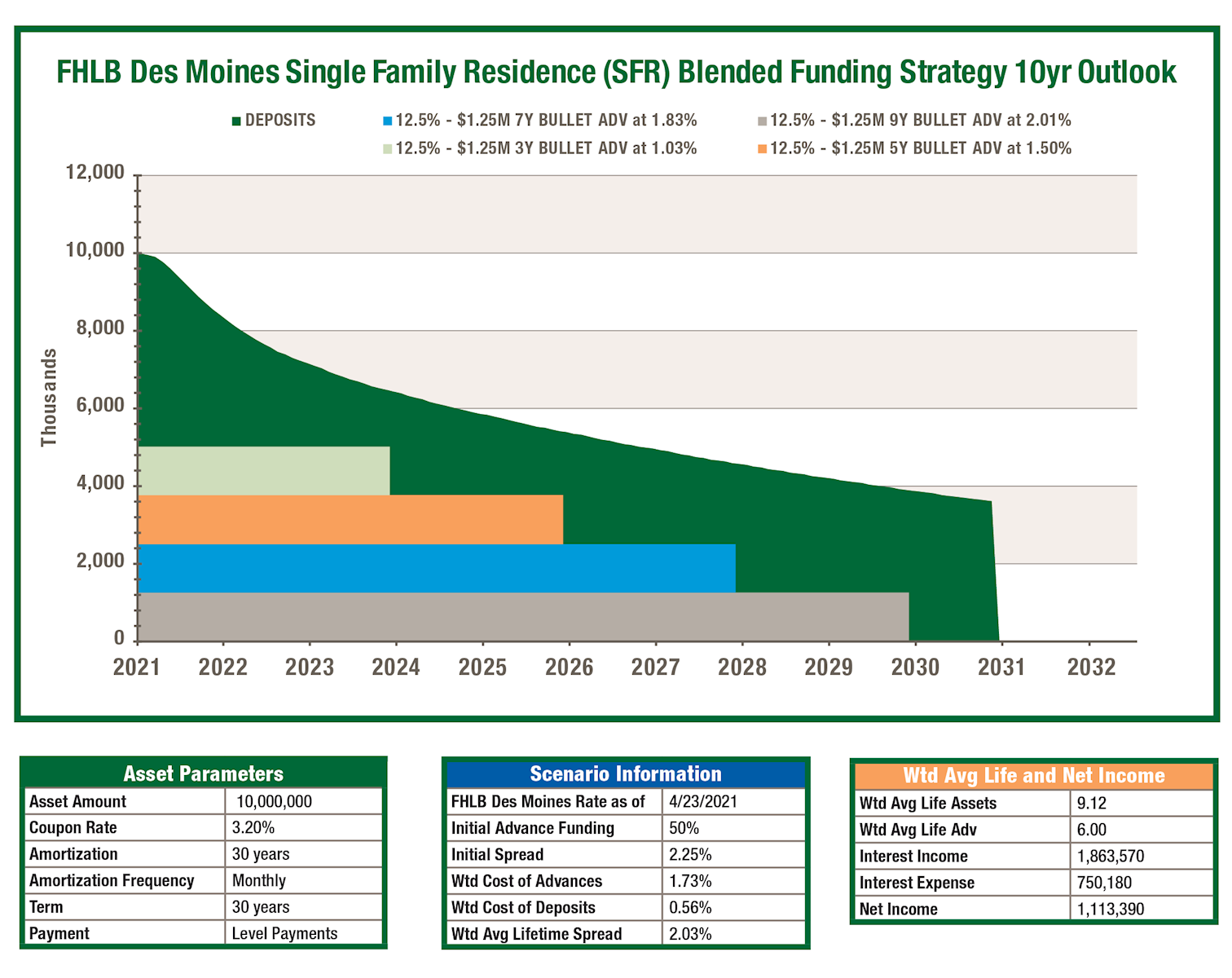

If your institution is looking to retain mortgages on the balance sheet and increase net income, consider using a blend of long-term, fixed-rate FHLB Des Moines bullet advances and deposits.

The long-term advances will lock-in a spread on a portion of the portfolio, taking advantage of low long-term advance rates before market rates begin to rise in the coming years. Using a mix of FHLB Des Moines advances and internal deposits allows for a spread in excess of 200 basis points, despite historically low mortgage rates.

Additional considerations:

Add on the symmetrical feature to potentially monetize prepayment of advances if market rates begin to rise. Use the Forward Starting Advance to lock in rates today for expected future portfolio growth. This allows you to take advantage of low rates today for expected future funding needs.

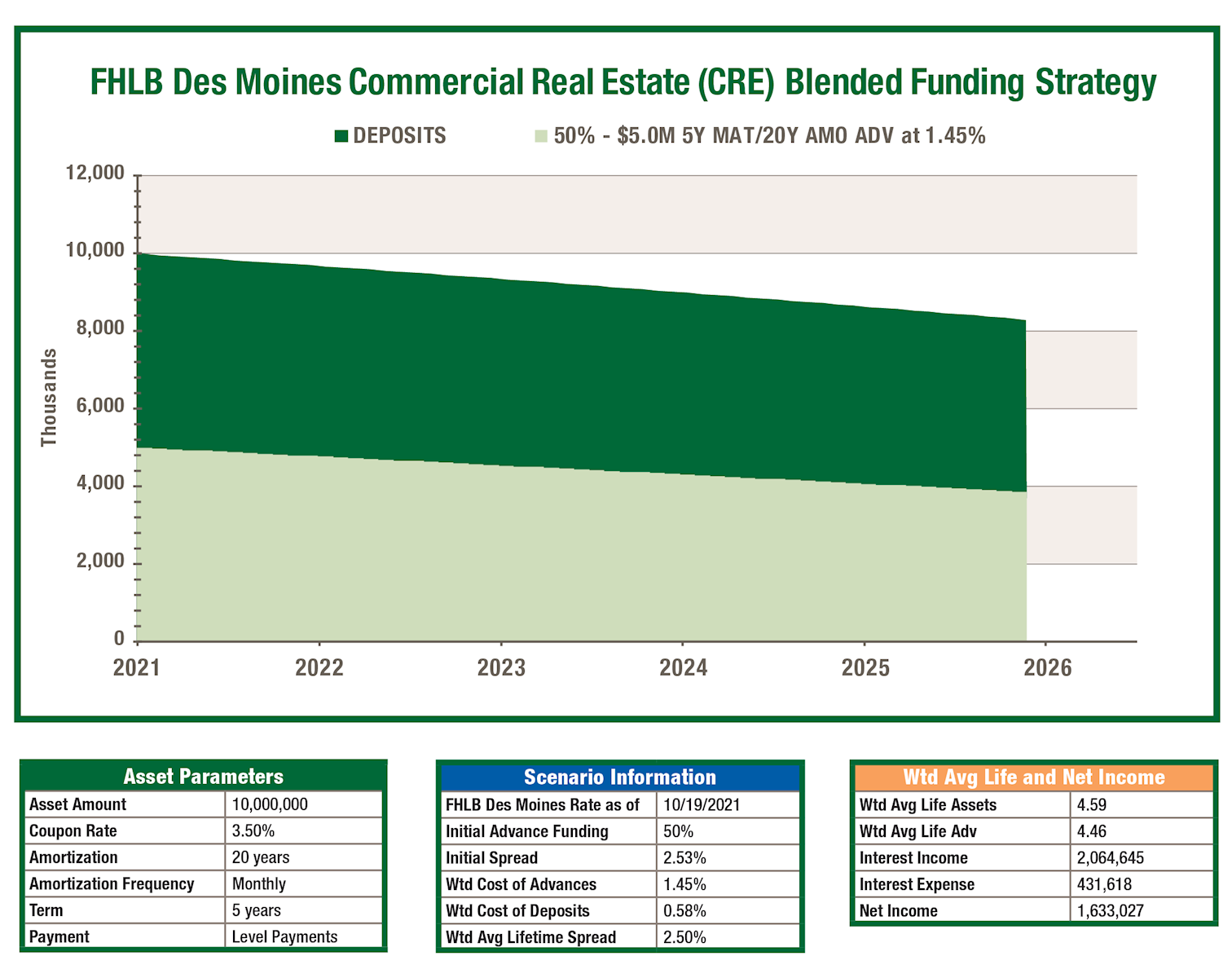

FHLB Des Moines amortizing advances offer the perfect hedge for any of your commercial real estate product term offerings. Use an FHLB Des Moines amortizing advance to match the amortization terms of any product you choose to offer.

FHLB Des Moines allows you to select the maturity date and amortization schedule of your choosing up to 30 years. In addition, you are able to dictate payment frequency, ranging from monthly, quarterly, semi-annual and annual payments.

Additional considerations:

Add on a prepayment feature to your advance for a small premium. If your offering includes no prepayment penalty after three years, consider an opt out option for your FHLB Des Moines amortizing advance after three years. This would mirror the penalty structure of the asset and guarantee no prepayment fees after the first three years of the advance.

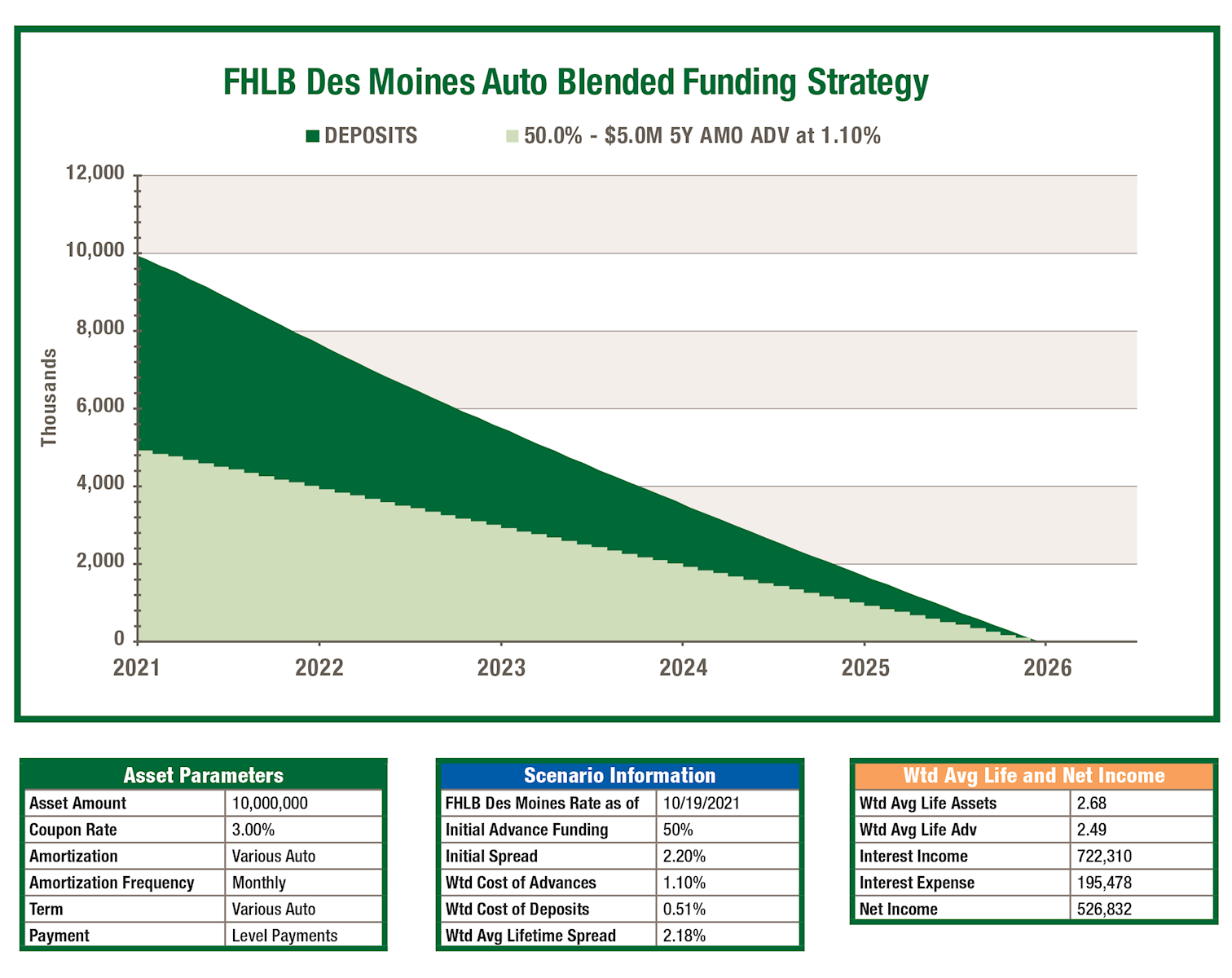

Consider an amortizing advance to hedge a portion of your auto portfolio. With the current steepness in market rates, FHLB Des Moines advance rates in the belly of the curve are extremely attractive.

Using these amortizing advance structures can help both hedge and fund your auto loan pipeline at rates below 1% on all terms less than seven years.