Legislative Update - 9/2/2020

last updated on Wednesday, September 2, 2020 in Public Policy Network

The Public Policy Newsletter provides our latest analysis and updates from Washington, DC on issues impacting the Federal Home Loan Bank of Des Moines.

Your input matters and is critical to our success. Please let us know your thoughts and how we can better serve you. Feel free to email our Government Relations team with any feedback. (Joe Cwiklinski, VP/Director of Government Relations at jcwiklinski@fhlbdm.com or Amber Morrow, Government Relations Manager at amorrow@fhlbdm.com)

Issue Analysis and Updates

Stimulus Update

Congress is scheduled to return from August recess on September 8 after Labor Day. The House and Senate failed to reach an agreement on a stimulus bill before adjourning earlier this month. In the absence of an agreement, the President issued a series of executive orders intended to provide relief to individuals impacted by the pandemic (more on that later).

The House passed its $3.4 trillion stimulus bill in May. House Speaker Pelosi and Senate Minority Leader Schumer have publicly said they would not support a stimulus bill that provides less than $2 trillion.

Senate Republicans are expected to vote on a $500 billion stimulus plan as early as next week. Their proposal reportedly provides $300 per week per individual in supplemental unemployment insurance, new authorization for small business loans, and funding for schools and COVID-19 testing and vaccines.

Both sides are over one trillion dollars apart. Whether Congress can get agreement on a stimulus bill before October remains unclear.

Government Funding

Congress must pass a Continuing Resolution (CR) before October 1 to avoid a government shutdown. The CR could serve as a potential legislative vehicle for stimulus legislation.

Could there be a government shutdown? Anything is possible, but both parties will have incentive to pass a CR before October so that Members have time to campaign for the November 3 election.

Over the last 40 years, only three government shutdowns occurred in the month prior to a November election (1984, 1986 and 1990). None of these shutdowns lasted more than three days.

Budget & Economic Numbers

Pay careful attention to the budget and economic numbers reported in September. They could very well determine whether Congress reaches an agreement on stimulus legislation. A growing number of Senate Republicans have voiced reluctance to agree to the next stimulus round due to the increasing deficit.

The Congressional Budget Office (CBO) estimates the deficit will more than triple from $900 billion to $3.3 trillion this year due to the pandemic.

The unemployment rate has fallen in every month since April but remains above 10 percent. (14.7 percent in April, 13.3 percent in May, 11.1 percent in June, 10.2 percent in July). The Bureau of Labor Statistics will report its updated August jobs numbers on September 4.

The Bureau of Economic Analysis (BEA) will report its updated Gross Domestic Product (GDP) numbers on August 27 and again on September 30. GDP fell by 5 percent in Q1 2020 and 33.2 percent in Q2 2020.

Bottom Line

If CBO reports a widening deficit in September, and the jobs and economic numbers show steady improvement, Republicans will be less likely to agree to a stimulus bill. On the other hand, if the economy shows little improvement or worsens in September, that could provide the impetus for a stimulus agreement to be reached before October.

Postal Reform

The House briefly returned from its August recess on August 22 to vote on Postal Reform legislation that would provide $25 billion in emergency funding for the U.S. Postal Service. The House passed the bill by a vote of 257-150. The Senate stimulus proposal that the Senate is expected to vote on next week reportedly provides $10 billion in funding for the Post Office.

REFI Fee Delay

On August 25, the Federal Housing Finance Agency (FHFA) said that it would delay Fannie and Freddie’s mortgage refinancing fee until December 1. Fannie and Freddie announced last month that they plan to charge a 50 basis point fee on refinance loans they purchase. FHFA further said that the fee will not apply to REFI loans with a balance of less than $125,000.

COVID Relief Executive Action

The Administration issued a series of executive actions on August 8 intended to provide relief to individuals impacted by COVID-19. Specifically, these actions would:

- Waive interest and allow individuals to defer payments on federally-owned student loans until December 31,

- Provide a federal contribution of $300 per week in unemployment supplemental assistance for individuals in participating states (called the Lost Wage Assistance program),

- Provide a payroll tax deferral from September 1 through December 31 for individuals earning less than $104,000 a year, and

- Direct HUD and other agencies to provide assistance to homeowners and renters. HUD has since announced it will extend the ban on evictions and foreclosures for loans backed by the Federal Housing Administration through the end of the year. FHFA has said that Fannie and Freddie would continue to buy loans in forbearance until September 30 extending that policy by one month.

The Federal Emergency Management Agency (FEMA) will provide $44 billion from its Disaster Relief Fund to pay for federal unemployment supplemental insurance (Lost Wage Assistance program). Individuals from participating states are eligible to receive a federal contribution of $300 per week.

States may also, but are not required to, contribute an additional $100 per week per individual. As of the time of this writing, only Kentucky and Montana had agreed to pay the additional $100.

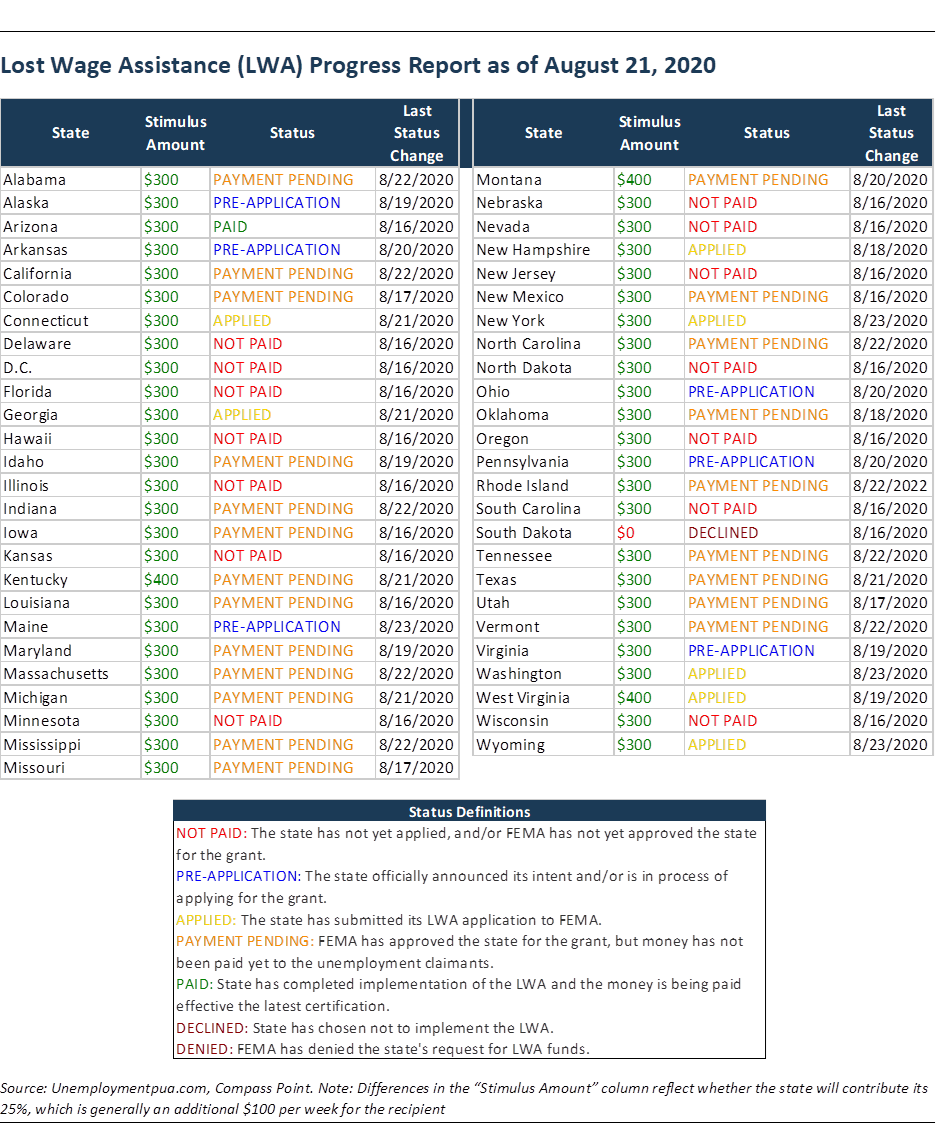

According to Isaac Boltansky of Compass Point Research, “approximately 22 states have been approved by FEMA but have not begun disbursing the additional funds, 13 states are in the application phase, 13 states and D.C. have yet to apply, Arizona has begun disbursing the benefit, and South Dakota has declined participation.” See chart below.

Mr. Boltansky estimates that the $44 billion in funds could “be exhausted in 5 to 6 weeks.”

Bottom Line

Again, pay attention to the economic and jobs numbers reported in September. They will provide the best indication whether Congress will reach a stimulus agreement before October and how large it will be.

Key Election Dates

The November 3 election is fast approaching. Both parties recently held their respective conventions. There will be three Presidential debates (September 29, October 15, and October 22) and one Vice Presidential debate (October 7).

For information on state voter registration, visit: https://www.eac.gov/voters/register-and-vote-in-your-state. For information on absentee and mail-in voting, visit: https://www.usa.gov/absentee-voting.

Finally, below are key dates for early voting. Dates may vary by county. Not all states offer early voting. For more information, visit: https://www.usa.gov/election-office.

Early Voting Starts (may vary by county)

- September 18 -- Minnesota, South Dakota and Wyoming

- October 5 -- Iowa, and Montana

- October 16 -- Washington

- October 19 -- Alaska, Idaho and North Dakota

- October 20 -- Utah

Early Voting Ends (may vary by county)

- October 30 -- Idaho, and Utah

- November 2 -- Alaska, Iowa, Minnesota, Montana, North Dakota, South Dakota, and Wyoming

- November 3 -- Washington