Collateral Reporting Change Effective July 1, 2020

last updated on Tuesday, April 14, 2020 in Business News

Beginning July 1, 2020, FHLB Des Moines members submitting their monthly loan listing using the General File Format must complete a Rate Index column in their file.

With the expected phase-out of the London Interbank Offered Rate (LIBOR) at the end of 2021, this addition was made to capture the referenced index for adjustable-rate loans pledged to the Bank via a loan listing.

A new column titled ‘Rate Index’ (column AL) will be included for all members using the General File Format, even if adjustable rate loans are not pledged. When reporting fixed rate loans, the Rate Index column will remain blank.

Numeric Codes for the Rate Index Column

1 = Prime

2 = SOFR - 1 mo

3 = SOFR - 3 mos

4 = LIBOR - 30 days

5 = LIBOR - 60 days

6 = LIBOR - 90 days

7 = LIBOR - 6 mos

8 = LIBOR - 9 mos

9 = LIBOR - 12 mos

10 = Treasury - 3 mos

11 = Treasury - 6 mos

12 = Treasury - 1 yr

13 = Treasury - 5 yr

14 = Treasury - 7 yr

15 = Treasury - 10 yr

16 = Other

Rate Index Example

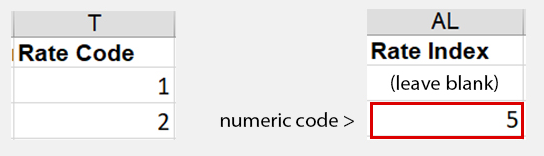

The following example demonstrates how the new Rate Index column will work.

The above image is a combined example.

If 1 is listed under the Rate Code (column T) then the Rate Index (column AL) is left blank.

If 2 is listed under the Rate Code (column T) then choose the appropriate numeric code for the Rate Index column (column AL). In this example, 5 is entered under the Rate Index (column AL) to represent the LIBOR 60 day index.

- Collateral

- Credit and Collateral